Yahoo: Right Media, or Social Media Junk CPM story?

What a difference five months and $680 million makes!

Yahoo hailed the advantages of its premium display advertising business in its Q3 2006 earnings call by touting it against “a whole proliferation of a lot of inventory in sort of the lower end of the non-premium range”:

A lot of the social media stuff, a lot of the network stuff that is being created, a lot of the ad networks are able to serve it. That is really focused on the low-end of the people who are not interested in the environments that they are in. They are simply interested in a specific performance ratio.

Defensively, in October, Yahoo bought a minority stake in Right Media, billed as the “largest emerging online advertising exchange.” Offensively, Yahoo is now acquiring the other 80% of Right Media, for $680 million in satock and cash.

Why? The inventory sold through the Right Media exchange is still of low-end, pre-emptable quality, not the high-end, premium priced inventory that Yahoo hangs its online advertising hat on.

In October, Yahoo underscored an “inventory glut” around social media, or User Generated Content (UGC); Yahoo reiterated today that USERS are only going to GENERATE more CONTENT, for more of the non-premium type inventory.

Yahoo on the “inventory glut” in October:

It has definitely been a huge change. You can see from the page views of a lot of the social media sites that exist today. That is going to change the market dynamics.

As the mix of online inventory continues to reflect an inexorable growth of lower quality UGC fare, the “market dynamics” continue to shift as well, downward. Negative pricing pressure will further deteriorate the market value of already lower priced inventory.

Why does Yahoo want in then? If you can’t beat them, rule them. Yahoo has to be a dominant player in any and every way the online advertising marketplace moves.

The market is going through a significant transition with new forms of inventory becoming available from a range of new and established competitors. This market shift represents great opportunity for Yahoo and we have already begun taking necessary steps.

Right Media is the Yahoo “response to the changing mix of available inventory.”

Rather than acknowledge the low pricing power of the billions of ad impressions that Right Media transacts daily, however, Yahoo is selling its high-priced investment in the low-end exchange as an inventory price booster!

So said Yahoo in October. Now, Yahoo claims Right Media has delivered; 50% increases in pricing for the Yahoo low-end inventory accorded to Right Media over the past months.Yahoo will also join the Right Media exchange and offers advertisers the ability to bid on Yahoo’s non-premium inventory through the open marketplace. This relationship gives Yahoo! an opportunity to lead and influence the development of this new and innovative marketplace. It makes it easier for marketers to purchase Yahoo inventory and has the potential to increase yield on non-premium inventory.

What is a 50% increase in Social Media Junk CPMs anyway? More junk? Is anything really significantly better than nothing?

Moreover, Yahoo has not even accorded Right Media much in the way of its own inventory, to support its historical price boosting contention.

No worry, Right Media to the metrics rescue, to report miraculous pricing power.

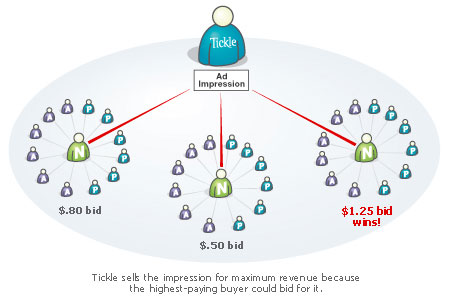

From Right Media, on the incredible 771% story of client “Tickle”:

Like many web publishers, Tickle regarded non-premium inventory as leftover: it never seemed valuable enough to warrant taking time away from premium sales. Accordingly, they had no real strategy for managing non-premium inventory, choosing instead to offload it to a few ad networks and monetize it as best as they could. If they made a few pennies off it, it was better than making nothing. Without adding management resources, it was a difficult business to scale.

Tickle’s perspective changed when they realized how valuable their non-premium inventory really was: direct response advertisers are spending more money than ever on remnant impression

They found one solution on the market: Publisher Media Exchange. With an automated system that allows buyers to openly compete for every non-premium impression in real-time, Tickle scaled their business without taxing resources and increased non-premium revenue by 771%.

Don’t expect a get rich quick report from Yahoo though, so advises Susan Decker, Yahoo CFO.

ALSO: Web 2.0 Social Media: Voyeurs rule, not amateurs! and

MySpace: Worth it, or not? and

Push Google off its search advertising throne? Not so FAST!