Yahoo's Bartz: "No comment" on Microsoft deal (but maybe a hint)

updated: Yahoo's earnings announcement - the actual financial numbers, that is - seems to be more of a formality these days. In a call with analysts today, CEO Carol Bartz made references to outsourcing or partnering pieces of Yahoo's business as the company rethinks its strategy under her leadership. Can we get a Microsoft announcement already?

During the call's Q&A, Bartz was asked if she was "well versed" enough to respond to a search deal yet, to which she responded - with a slight matter-of-factly tone - that she was, in fact, "well versed enough in the search business at Yahoo to say its absolutely critical to Yahoo... Relative to anything else with Microsoft, I have no comment."

The blogosphere is already buzzing about a deal between Yahoo and Microsoft, with talks being labeled "hot and heavy" on Kara Swisher's Boomtown blog, which cites a source who said that news of a "lucrative agreement" could come sooner than many expect.

Still, Bartz stayed focused on the call, highlighting the pieces of the business that are strong enough to create a "Wow" experience for users and advertisers and how others have the same potential. There are some products - mail, finance, sports, mobile and others - that are strong and will continue to grow. There are others that are weaker and might be more of a drain than they're worth. In those cases, maybe outsourcing, partnering or even discontinuing the service is necessary to make eliminate duplication and reallocate resources.

Partnering? Like with Microsoft? On search? Are these supposed to be subliminal hints?

As for the formalities of the quarter:

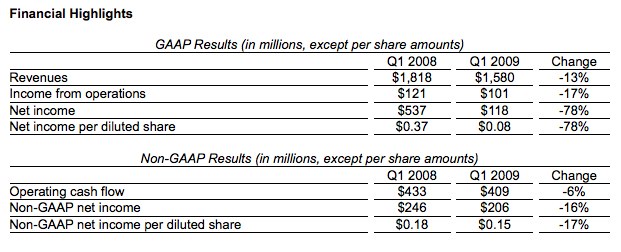

The company reported a first quarter net profit of $118 million, or 8 cents per share on net sales of 1.58 billion. Profits were down 78 percent, compared to the same quarter a year ago and revenues dipped 13 percent. (Statement) Excluding items, the company reported earnings of 15 cents per share. Wall Street had been expecting first quarter earnings of 8 cents a share on revenue of $1.2 billion, according to Thomson Reuters.

The quarter marked the first full one for Bartz, who received a bit of a pass when the company reported fourth quarter results in January because the company was being run by co-founder Jerry Yang at the time.

The company also noted that the first quarter 2008 profit included a non-cash gain of $401 million, or $0.29 per diluted share, related to the initial public offering of Alibaba.com

That said, there are plenty of sideshow distractions to divert attention away from the numbers. In a post this morning, Larry Dignan looks at some of the movements that could prompt concerns about the financials to be put on the back burner, including a restructuring plan that will include the third round of layoffs in 14 months.

Shares of Yahoo were up more than 5 percent in regular trading, closing at $14.38. Shares were up more than 3 percent in after-hours trading.