YouTube's an e-commerce power: Google

Google is recognising YouTube as more than just a video-sharing site, seeing it also as a network for e-commerce and building brands worldwide.

Speaking during the company's first-quarter conference call with investors on Thursday afternoon, chief business officer Nikesh Arora noted that "YouTube has gone from an interesting ad buy to key buy for brands".

YouTube, in particular, has real potential for e-commerce, given that at the heart of things, it is a social network that is accessible from nearly any device (ie, computer, mobile device, TV) connected to the internet.

Arora remarked that YouTube is "fast becoming the platform for the next generation of channels", with initial success selling sponsored channels for large companies, such as Toyota and GM.

Beyond that, YouTube has 100 new original channels in the pipeline, along with several new products, such as YouTube Live and YouTube TrueView video ads, to further entice advertisers.

Taking a page from what television "has been doing forever", Google will be hosting its first YouTube upfront for brands and agencies, showcasing the platform in May. Part of the motivation here is that marketing agencies from major brands are starting to recognise the value of digital media.

Arora addressed how Google is seeing YouTube's place in cross-media measurement:

Search advertising has always been highly measureable, and we have been leading the industry. Not only in search, but in display, mobile and now video. We're actually taking that one step further, and trying to move that measurability into offline sales, to new areas. But they invest serious money only when they can measure the results. We are rolling out best-of-bleed measurement technologies so all clients can measure their ROI, whether their goals are online conversions or just the ability to compare offline and online media.

The key point there is understanding what YouTube could do for businesses offline. Arora acknowledged that in the past, YouTube was usually seen as a tool for getting internet users to a brand's website. Yet the opportunities have evolved considerably.

Now they're seeing the benefit of using the web for brand affiliation, and for brand recognition. We are beginning to have a different sales pitch with the large brands, which is oriented towards them coming and getting their brand seen on the web, and YouTube is a phenomenal tool in that regard.

Then we're able to package our demographic based inventory around the Google display network, around YouTube, and actually get the brands to engage in a large campaigns, which can run the millions of dollars. This was a capability we couldn't have a few years ago, because the inventory didn't exist, [and] all the demographic tools didn't exist. Clearly, this is a new space and new sort of pitch to our brand advertisers, and, as I said, we are trying to light this up across our sales force around the world in 60 countries.

The first-quarter earnings it revealed before talking about YouTube were better than expected, but revenue was a bit light. The company also approved a two-for-one stock split, but maintained a structure that leaves control with founders Larry Page and Sergey Brin.

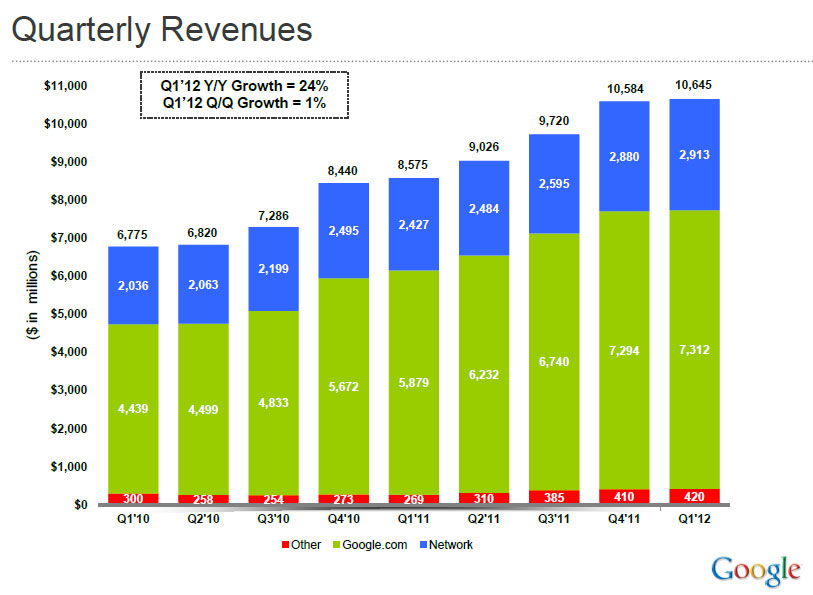

The company reported first-quarter earnings of US$2.89 billion, or US$8.75 per share, on revenue of US$8.14 billion excluding traffic-acquisition costs. Including traffic-acquisition costs, Google revenue for the quarter was US$10.65 billion. Non-GAAP earnings came in at US$10.08 per share.

(Credit: Google)

Wall Street expected Google to report first-quarter earnings of US$9.65 per share on revenue of US$8.15 billion, excluding traffic-acquisition costs.

Cost per click rates were down 12 per cent from a year ago. That decline was worse than expected, and may reflect more mobile and tablet traffic.

Overall, the company was upbeat about its outlook. CEO Page in a statement called the quarter "great", touting 24 per cent revenue growth and the momentum of Android, Chrome and YouTube.

On a conference call, Page said that the company has improved its product velocity, and has redesigned products throughout.

I've pushed hard to increase our velocity, improve our execution and focus on the big bets that will make a difference in the world. Google's a large company now, but will achieve more and do it faster if we approach life with the passion and the soul of a start-up. This has involved a lot of clean-up. We've given many of our products, including search, a visual refresh, so they now have a more consistent look and feel.

In afterhours trading, investors didn't worry over cost-per-click rates, and cheered a stock split.

By the numbers for the first quarter:

- Google site revenue was US$7.31 billion, up 24 per cent from a year ago

- Network revenue was US$2.91 billion, up 20 per cent

- 54 per cent of Google's revenue was international; UK revenue was 11 per cent of sales

- Paid clicks were up 39 per cent from a year ago

- Other costs of revenue — read: datacentre investment — were up 12 per cent to US$1.28 billion in the first quarter

- Google employed 33,077 full-time workers as of 31 March.