Avis buys Zipcar for $500 million: A look at the IT threads

Avis bought car sharing company Zipcar for $500 million and the deal largely revolves around a series of business technology threads. Think of Avis as the supply chain and procurement infrastructure and Zipcar as the brand and front-end customer experience.

Under the terms of the deal, Zipcar shareholders get $12.25 a share in cash, good for a 49 percent premium. Avis' debt ratio increases a bit, but Zipcar gives the car rental company access to younger consumers, points of presence in cities and college campuses, mobile apps and a good brand.

Speaking on a conference call, Avis Budget Group CEO Ronald Nelson said the company can manage Zipcar's back-end more efficiently by procuring cars at better rates. Nelson also said Avis will maximize revenue at Zipcar by managing its inventory of vehicles better on weekends. Nelson also said that it'll take Zipcar's "customer friendly technology" and leverage it.

The deal is evolutionary since car rental and car sharing basically go together without a lot of cannibalization. Here's a look at the business tech justification for the deal:

Inventory management and procurement. Avis has the scale and relationships to buy more cars in bulk. Avis also manages a large fleet of vehicles and has been implementing technology to track them better. Nelson said:

This transaction will enable Zipcar to create and implement new and even more flexible service offerings as well as help meet the need for vehicle availability during higher yielding periods of peak demand. Specifically, as a result of this combination, we will be able to add more cars for more Zipcar members in more parts of the world quicker and be more profitable. Positions in Europe, the Middle East and Asia will provide incremental growth opportunities for Zipcar as we leverage our expertise, scale and partnerships and fleet.

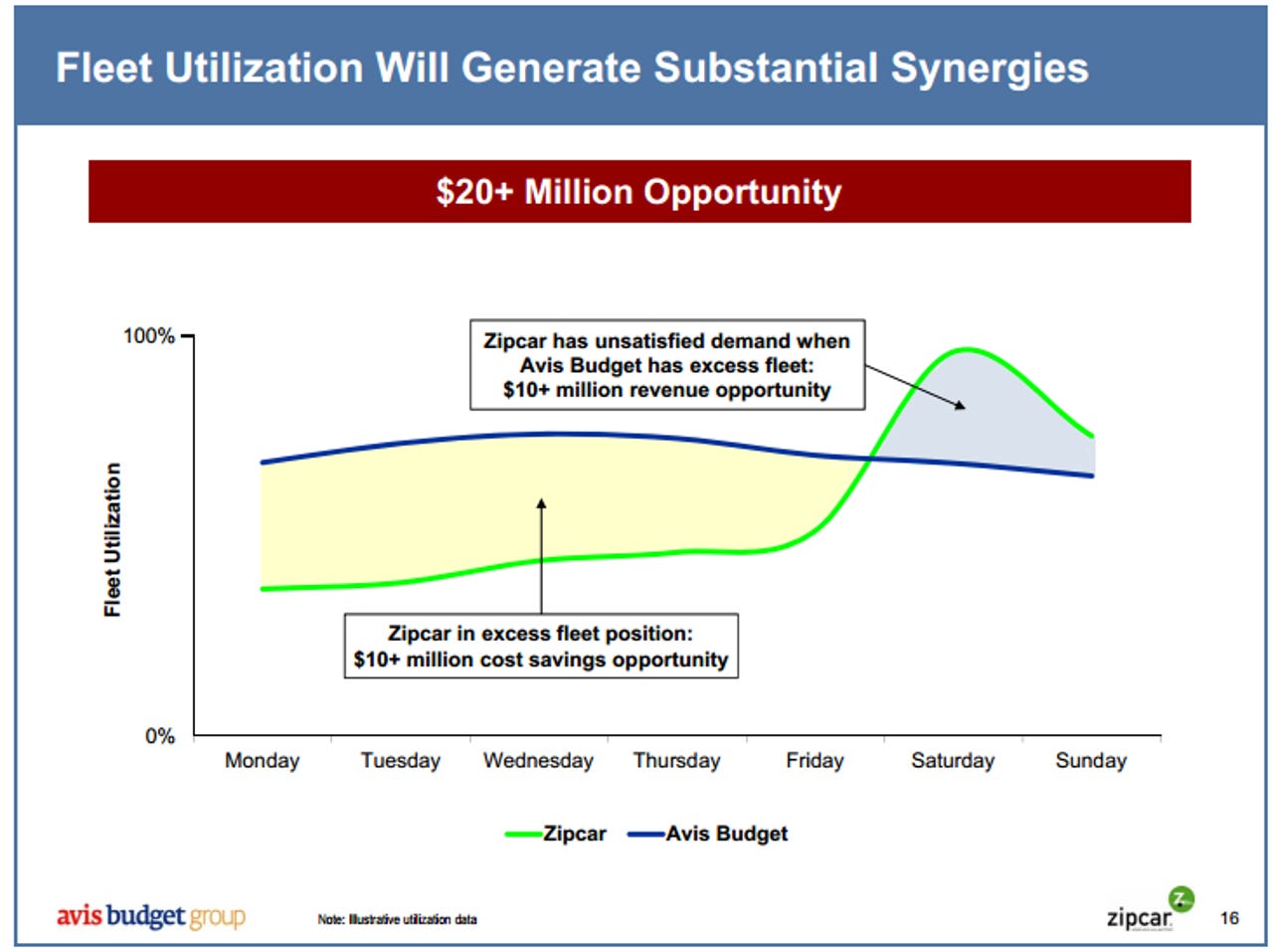

Zipcar's utilization is quite low Monday to Friday but is extremely high on Saturday and Sunday resulting in them having excess fleet during the week and often not being able to capture all of the profitable demand from their membership base on weekends.

Customer relationship management. Avis gets access to a younger tech savvy consumer. Nelson said:

New transportation usage occasions not well served by our traditional model. It enables us to serve new, younger, more wired consumer that are existing brands don't always connect with.

Zipcar brings front end apps to Avis. Nelson added:

The future of personal mobility is taking shape now. Consumers increasingly access a variety of on demand mobility options from their smart devices and we and Zipcar share...Zipcar benefits from extremely favorable word of mouth among its members often expressed through social media and uses unique customer friendly digital interfaces.

Sounds great right? Not so fast. First, Zipcar CEO Scott Griffith and operating chief Mark Norman will continue to lead the company under the Avis umbrella so there's continuity. The problem with integration is there is inevitably some technical hurdle and engineering talent leaves. Ask United Continental about how IT integration screw-ups hamper customer service.

A company like Zipcar relies almost exclusively on its front end technology. If Zipcar customers suddenly find themselves in an Avis phone tree there will be issues. Fleet management is also notable and Nelson added that Avis will have to add Zipcar technology to current autos.

He said:

In terms of the execution of the Zipcar technology, obviously we're going to have to equip some of the Avis Budget fleet with some of these. If it's 5,000, 6,000 or 7,000 cars that we need to satisfy the unmet demand, those are cars that could be multipurpose. They could work at the airport during the first part of the week and they can work in the local market, fulfilling Zipcar demand towards the end of the week. So you should expect to see us install some of their technology in our cars, but with the fleet of nearly 500,000 vehicles I think we're not talking about a huge portion of our fleet.

On paper, the Avis-Zipcar merger makes a lot of sense, but most deals sound fine initially. The execution is where things unravel. It remains to be seen if Avis can be hands off on Zipcar's tech when it needs to and add value and whittle costs elsewhere. In the end, the success of the deal revolves around whether Zipcar customers notice any integration hiccups.