Apple earnings on tap: Strong iPhone, Mac demand expected; iPad supplies in focus

Apple fiscal second quarter financial results are expected to shine amid strong Mac and iPhone sales, but a lot of analysts will be looking for color on iPad demand and component shortages.

The company's comments about the iPhone will also be closely watched.

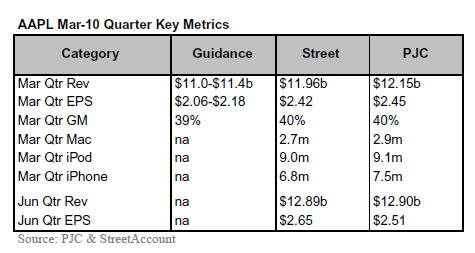

Apple is expected to deliver fiscal second quarter earnings Tuesday of $2.43 a share on revenue of $12.05 billion, according to Thomson Reuters. For the third quarter ending June 30, Apple is expected to report earnings of $2.69 a share on revenue of $12.94 billion. Analysts expect Apple's outlook to miss those targets. Over the last 15 quarters, Apple has guided revenue 4 percent below Wall Street targets and 12 percent on earnings, according to Piper Jaffray. Then the company tops estimates handily.

To say analysts were upbeat about Apple's quarter would be a bit of an understatement. Oppenheimer analyst Yair Reiner said in a research note that Apple's March quarter "should be a beauty."

Among the key points to watch: iPad production. Apple last week said that it was delaying the international rollout of the iPad due to strong demand in the U.S. Apple also said it sold 500,000 iPads since launch. Piper Jaffray analyst Gene Munster said that there's a lot of uncertainty around the iPad supply situation. Analysts will be looking for any comments about supply constraints. Munster expects Apple to sell 1.3 million iPads in the quarter ending June 30.

The next release of the iPhone. Apple's outlook, which is almost always too conservative, isn't likely to bake in the refresh of the iPhone, said Reiner. Without a new iPhone, units of the popular phone can be expected to drop (they always do ahead of a new version). Munster expects Apple to ship 7.5 million iPhones in the March quarter, well above the 6.8 million consensus estimate. The big wild-card for Apple's iPhone lineup is the timing of a new version.

The next release of the iPhone. Apple's outlook, which is almost always too conservative, isn't likely to bake in the refresh of the iPhone, said Reiner. Without a new iPhone, units of the popular phone can be expected to drop (they always do ahead of a new version). Munster expects Apple to ship 7.5 million iPhones in the March quarter, well above the 6.8 million consensus estimate. The big wild-card for Apple's iPhone lineup is the timing of a new version.

Caris & Co. analyst Robert Cihra said in a research note:

Timing of an iPhone refresh (late June vs. early July) remains a near-term swing-factor but we nevertheless expect a strong cycle driven by OS 4.0 and more significant hardware advances than the 3GS.

Mac sales. There's a bit of uncertainty about Mac sales even though PC demand has been surging overall. Susquehanna Financial Group analyst Jeffrey Fidacaro said that IDC data for Apple indicates Mac unit sales may be weaker than expected. However, Fidacaro's checks and NPD data counter IDC's take.

Munster is also upbeat about Mac sales. Munster is expecting Apple to ship 2.9 million Macs for the March quarter. "We believe we will see meaningful near-term upside from the Mac business," said Munster. Other analysts agreed. Some noted that PC vendors were seeing average selling prices rise and that means Apple, which garners higher price points, may grab share.

Overall, here's Munster scorecard of what to expect.

Related: