Dell buys Wyse, plays 'cloud client' game

Dell said it will acquire Wyse Technology in a move that gives the company more virtualisation heft and an entry in thin computing.

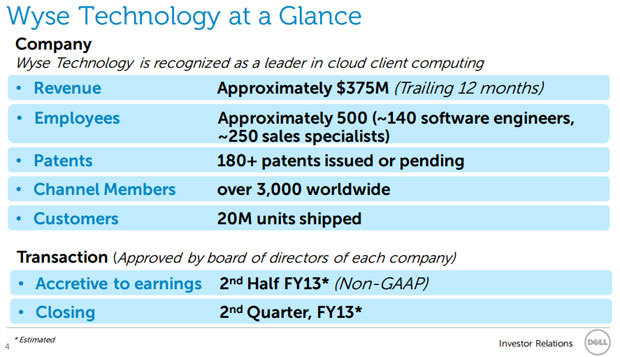

Terms of the deal weren't disclosed, but Dell expects Wyse to add to its fiscal 2013 earnings.

According to Dell, Wyse will complement its enterprise portfolio and give it a "cloud client" addition to its product line-up. Dell has been on an acquisition tear of late as it gobbles up software vendors to extend its reach.

(Credit: Dell)

Wyse made its name making thin clients, but has expanded into desktop virtualisation software as well as hardware. In some respects, Dell's move to buy Wyse will put it in competition with VMware and Citrix. Wyse has shipped more than 20 million units and has a broad intellectual property portfolio.

Dell said Wyse will add thin clients, cloud management software and mobility tools to its arsenal. Wyse portrayed the Dell acquisition as a part of its natural evolution. For Dell, Wyse completes a hardware stack that extends from the datacentre to servers to PCs to thin clients.

On a conference call with analysts, Dave Johnson, senior vice president of corporate strategy at Dell, said that the company continues to expand its intellectual property portfolio either organically or via acquisition. He said Wyse gives Dell a strategy "from the edge to the core of the cloud".

(Credit: Dell)

Wyse has about US$375 million in trailing 12-month revenue and 500 employees. Dell also gets 140 software engineers with that talent acquisition.

The deal will close in the second quarter.

(Credit: Dell)

In a research report, Sterne Agee analyst Shaw Wu said the Wyse purchase price looked fair for Dell. Wu estimated that Dell paid about US$400 million to US$600 million for Wyse. The poser for Wu is whether Dell should have partnered with VMware and Citrix instead of buying Wyse. Wu said:

The big question on investor minds is whether Dell could have chosen to partner with Citrix and VMware more on software, instead of deciding to acquire. In addition, another concern is whether Dell is involving itself into more lower-margin commodity hardware.

Via ZDNet US