Dell delivers: Is a turnaround in sight?

Dell's fiscal first quarter results topped expectations courtesy of strong growth in its commercial and consumer businesses.

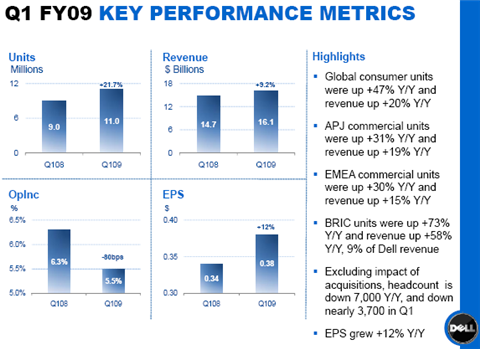

On Thursday, Dell reported net income of $784 million, or 38 cents a share, on revenue of $16.07 billion, which was up 9 percent from a year ago. Wall Street analysts were expecting earnings of 34 cents a share on sales of $15.68 billion, according to Thomson Financial.

The results (statement, all resources) were impressive given that Dell had a tougher comparison to a year ago relative to what the company will face in future quarters.

Dell said it is seeing early signs of turnaround progress, but noted that the company is "seeing conservatism in IT spending in the U.S. particularly with its global and large customers as well as public, small and medium business accounts."

Dell added that it expects this cautious spending to continue through the summer. In a presentation to analysts, Dell CFO Don Carty said that the company still has a lot more work to do on its turnaround plans. Dell characterized its quarter as a first step in restoring the company's competitiveness and reiterated plans to save $3 billion.

By the numbers:

- Average revenue per unit was $1,470, down from $1,630 a year ago.

- Gross margins were 18.4 percent, down from 19.3 percent a year ago.

- Dell had 9 days of inventory, up from 6 a year ago. Days sales outstanding clocked in at 36 up from 31.

- Desktop revenue, which accounts for 29 percent of Dell's sales, was $4.7 billion in the first quarter, down 5 percent from a year ago. Notebook revenue (31 percent of sales) was $4.9 billion, up 22 percent from a year ago.

- Servers and networking sales were $1.65 billion, up 4 percent from a year ago with storage posting a 15 percent rise to $631 million. Services revenue was up 14 percent to $1.44 billion and software and peripherals jumped 17 percent to $2.74 billion.

- First quarter in the so called BRIC countries--Brazil, Russia, India and china saw unit growth of 73 percent and revenue growth of 58 percent. These countries now account for 9 percent of Dell's total revenue.

- Consumer revenue was up 20 percent with market share ticking up 1.2 points to 8.8 percent. Dell now has 13,000 retail locations in its channel.

- Research and development spending was $152 million in the first quarter, up 7 percent from a year ago.

- The company has reduced its headcount by 7,000 so far this year and ended the quarter with 79,900 employees.

- Dell ended the quarter with $9.8 billion in cash.

Dell's message seems simple enough: It is making progress, but isn't all the way back yet. Here's Dell's summary of where it stands today: