Dell's grand plan a dud with analysts; Where's the detail?

A two-day Dell powwow with Wall Street this week was largely panned as being short of details.

On Wednesday and Thursday Dell met with analysts and disclosed that it would lay off more than the 8,800 it had projected and outlined plans to save about $3 billion over three years. The bright side: "Our takeaway was that management does understand what needs to be done, which is a big positive compared to efforts in '05-'07," said Cowen analyst Louis R. Miscioscia. The rub: "Many questions were still left unanswered," he said.

The consensus view is that Dell is a wait and see company. Dell's plans look fine on paper, but there aren't enough details. Meanwhile, IT spending is questionable. Toss in the fact that Dell will essentially run two business models--its core direct sales business and a channel effort--in parallel and the risk increases. Dell's supply chain is also being run in parallel: Dell will manufacture and outsource a bit. Can you really squeeze out efficiencies when you're running two different business models that aren't integrated?

That question is one big reason why W.R. Hambrecht downgraded Dell shares to a hold from a buy. In a report, W.R. Hambrecht analyst Matthew Kather wrote:

We are downgrading Dell's shares to Hold from Buy due to the following reasons: Dell did not give a convincing argument regarding the ability to manage, overcome and optimize the channel conflicts that are expected to emerge in changing from direct to much for VAR business, and retail business. They appear to be in denial of the channel conflicts. Cost cutting likely not enough and likely not all of $3B will fall to bottom line. Headcount reduction will have to be significantly more in our opinion. Services strategy was not concrete enough, unclear how much Dell plans to compete with its current VAR clients, and how it will 'white brand' services to the enterprise. The opportunity to accelerate growth is clearly there in our view, but the Company is enormous and it is going to take time (2+ years) to learn how to manage their new channels, and the financial model (COGS, Opex) does not show enough leverage yet in our opinion.

One of the big worries among analysts is that Dell is underestimating the difficulty of executing a multi-channel, multi-supply chain business. HP has had years to get the drill down. Dell is a newbie.

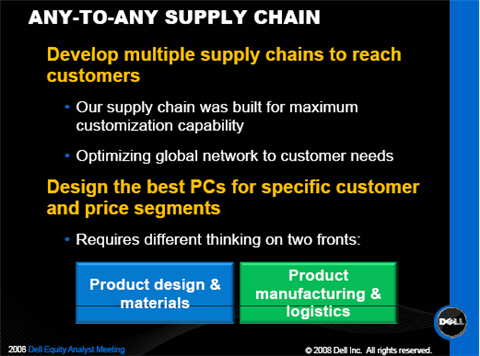

This chart is more complicated in the real world:

And this isn't a picnic either:

Merrill Lynch's Jeff Fidacaro notes:

Dell identified its largest opportunity to improve margins from designing platforms per price bands, a departure from its customizable configurations. This includes implementing a multiple supply chain strategy including increased usage of manufacturing partners (ODMs and EMS).

Simply put, Dell has more than a few moving parts to manage.

It doesn't help matters that Dell didn't disclose how much of its $3 billion in cost savings will flow to the bottom line. Will earnings get a boost? Or will the savings be reinvested? We just don't know at this juncture. It took three years for Dell to schedule an analyst meeting and the least the company could do is serve up a little more detail.