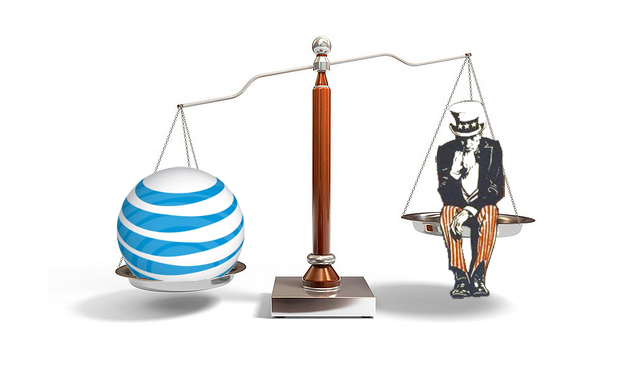

Feds aim to block AT&T's T-Mobile purchase: The fallout

AT&T portrayed its acquisition of T-Mobile as a way to boost 4G services, build out its network, alleviate a wireless spectrum crunch and boost jobs. AT&T just Tuesday said it would repatriate 5,000 call center jobs to the U.S.

The Department of Justice, however, is wary of having two companies control 80 percent of the postpaid wireless market and wants more consumer choice. What's unclear at this juncture is whether the complaint filed by regulators on Wednesday is an opener to prod AT&T to divest assets too close the T-Mobile deal or a nail in the merger coffin. AT&T will have an appeal.

Also: U.S. Justice Dept. moves to block AT&T, T-Mobile merger

According to the DOJ:

The department said that it gave serious consideration to the efficiencies that the merging parties claim would result from the transaction. The department concluded AT&T had not demonstrated that the proposed transaction promised any efficiencies that would be sufficient to outweigh the transaction’s substantial adverse impact on competition and consumers. Moreover, the department said that AT&T could obtain substantially the same network enhancements that it claims will come from the transaction if it simply invested in its own network without eliminating a close competitor.

Deputy Attorney General James Cole said at a press conference:

The Department filed its lawsuit because we believe the combination of AT&T and T-Mobile would result in tens of millions of consumers all across the United States facing higher prices, fewer choices and lower quality products for their mobile wireless services.

For now though it's worth handicapping the key winners and losers.

Winners

Sprint comes out ahead. Sprint was one of the more vocal opponents of the AT&T purchase of T-Mobile. While AT&T CEO Randall Stephenson said the AT&T acquisition was patriotic and would bolster U.S. competitiveness, Sprint said the deal was a land grab that would consolidate power. Simply put, Sprint would have had a tough time competing as a distant No. 3. Now that picture looks better. Sprint would still be No. 3, but could grab more customers from a now weakened T-Mobile. Wall Street pushed Sprint shares about 7 percent higher on the news.Verizon will remain top dog. Verizon is likely to take advantage of the T-Mobile distraction for AT&T and can also poach customers from T-Mobile. Meanwhile, AT&T will now have to spend more on its network and acquire more spectrum to broaden its 4G footprint.

Consumers also may gain. T-Mobile was a down market carrier in many respects and was playing with a value pricing model. It was possible that AT&T would allow T-Mobile to keep its identity, but over time it would have been absorbed. Consumers may garner good deals as T-Mobile moves heaven and earth to keep current customers and attract new ones.

Losers

T-Mobile may be doomed. It's hard to see a scenario where T-Mobile comes out ahead. Without an exit, T-Mobile is a No. 4 carrier that is losing customers each quarter. With Sprint increasingly more competitive and AT&T and Verizon domination continuing, it's unclear what T-Mobile can do. A merger with Sprint could be possible, but the networks are on different technologies.Deutsche Telekom gets consolation prize, but little else. If AT&T-T-Mobile deal falls apart, Deutsche Telekom gets a $3 billion consolation prize in a breakup fee. AT&T was very cocky about getting regulator approval to agree to such a massive fee. In the short-term, Deutsche Telekom gets a nice wad of cash. However, Deutsche Telekom still has to figure out what to do with T-Mobile in the long run.

AT&T will need to invest more. AT&T doesn't need T-Mobile per se and will be fine without the acquisition. However, AT&T needs more wireless spectrum and needs to expand its network footprint. The T-Mobile deal would have ultimately saved AT&T some dough on a network build-out.

Related:

AT&T makes its T-Mobile case: Patriotism, spectrum crunch, mobile broadband

- AT&T buys T-Mobile, woos regulators; Sprint in trouble?

- AT&T buys T-mobile to create the new top dog in US wireless

- AT&T and T-Mobile Merger: Do Enterprises Win?

- AT&T buys T-Mobile - How do customers feel about that?

- Can Sprint win over regulators in AT&T, T-Mobile merger?

- CNET: Justice Dept. to block AT&T's T-Mobile deal

- AT&T promises 5,000 new jobs after T-Mobile merger