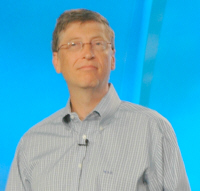

Gates: IBM, not Google, Microsoft's chief rival

Gates identified IBM as the top competitor, according to a Reuters interview, quoted below.

"I'm never going to change the press's view about what the 'cool company' to write about is. That's Google, No. 1, and Apple, No. 2. Too bad for Nokia, Sony and all those others."

"The biggest company in the computer industry, by far, is IBM. They have the four times the employees that I have, way more revenues than I have. IBM has always been our biggest competitor. The press just doesn't like to write about IBM."

Size matters, not market cap and press attention, Gates seems to be saying. Based on market caps around 1:30 PM EST today, Google is gaining ground, surpassing IBM.

- General Electric $372 B

- Microsoft $288 B

- Google $132.5 B

- IBM $130 B

- Time Warner $83 B

- Apple $62 B

- Sony $42 B

- Yahoo $59 B

The value accruing to Google is certainly more of a concern to Microsoft than IBM. Gates is persistent and consistent is his view of Microsoft as a software company and that software is at the center of the enterprise, Internet and digital media revolution/evolution. Microsoft and IBM are going head-to-head in the enterprise across servers, databases and management software and platforms--Java/Linux/open source vs. closed .Net.

At the same time Microsoft is competing against Google and others for the very lucrative next-generation portal, application platform, digital delivery and ad/subscription-based business model. Google's valuation and escalating stock price reflect that generally accepted belief that future hypergrowth is in Internet-centric platforms. So, while IBM is Microsoft's chief competitor by far according to Gates, Google--not Sony, Apple, Oracle, open source, or brand X--has to be a close second and a great motivator for change at the company. At least, that's how Ray Ozzie, Gates' hand-picked CTO, thinks about his particular challenges. In October, Ozzie said that Google was a "great wake up call and rallying point for people in the company." No doubt, the wily Gates, with 30 years under his belt, is keeping a close watch the Googlers...