Google earnings solid, company signals investment ahead

Google reported solid first quarter earnings today, beating Wall Street's estimates. For the quarter, the company reported non-GAAP net income of $2.18 billion, or $6.76 per share. Sales for the quarter were $5.06 billion. Wall Street analysts had been expecting earnings of $6.56 per share on revenue of $4.93 billion. (Statement, Preview)

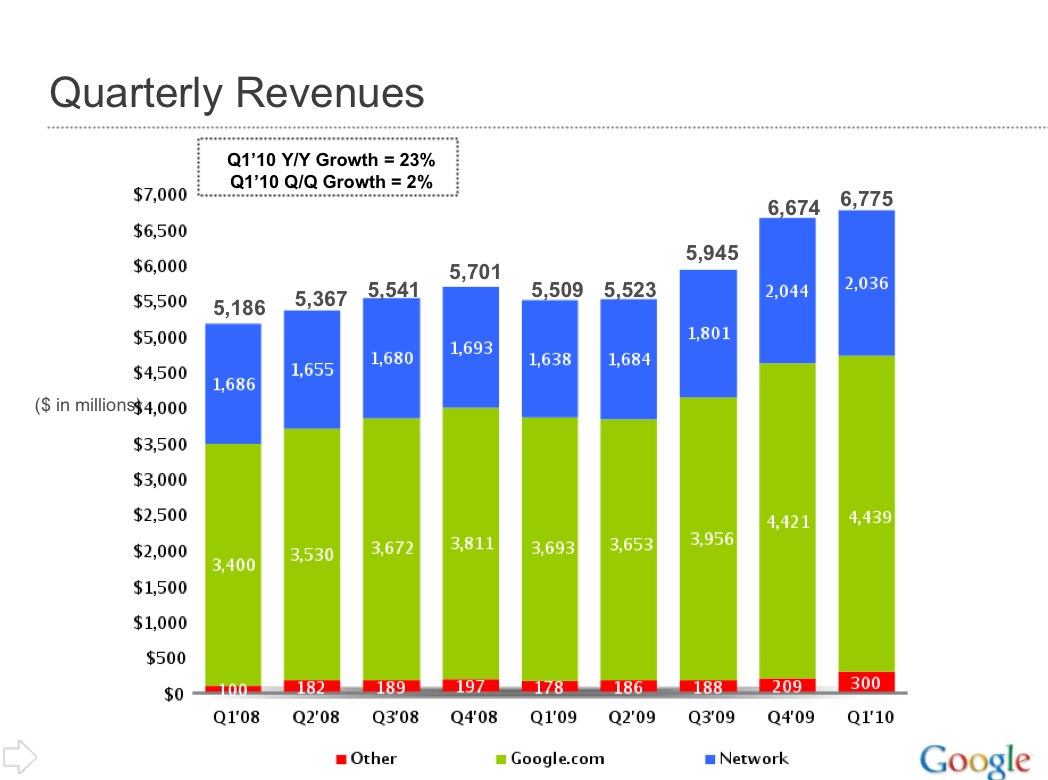

On a GAAP basis, the company reported net income of $1.96 per share on sales of $6.77 billion, a 23 percent jump from the year-ago quarter.

In a statement, Google CFO Patrick Pichette said:

Google performed very well in the first quarter, with 23% year over year revenue growth driven by strength across all major verticals and geographies. Going forward, we remain committed to heavy investment in innovation -- both to spur future growth in our core and emerging businesses as well as to help build the future of the open web.

The company had a busy first quarter, including a showdown with the Chinese government and a new mobile phone strategy that includes direct-to-consumer sales of the Nexus One smartphone. The company didn't address either of those news events in its earnings release but surely it will be a topic of conversation when the company hosts a conference call with analysts this afternoon.

Specifically, investors will want to know about long-term plans in China, where the China site is currently being re-routed to the Hong Kong site. They'll like also want an update on the Nexus One, which reportedly has fallen short of expectations, and whether the company can sustain its strategy to sell mobile devices independent of carriers.

In the conference call, Pichette said that Nexus One, as as standalone, is profitable. The company won't, however, release specific sales numbers. He did say that the company is "very happy with the uptick" and said the device is raising the bar on mobile devices.

Starting with this quarter, CEO Eric Schmidt will no longer lead the conference call for investors, leaving that duty for Pichette. Some highlights from Pichette's prepared opening remarks:

- The company is actively and aggressively hiring, largely for sales and engineering positions. The total workforce grew from 19,835 to 20,621 employees in the quarter.

- In terms of products, the company said it's "pushing the envelope" with innovative products such as Google Goggles, which is focused around visual search on smartphones.

- The company has been active with acquisitions and has a "strong M&A pipeline in place," bringing new technology and talent to the company.

- Android adoption is strong, with 34 devices by 12 different OEMS and now more than 38,000 apps, a 78 percent jump from the fourth quarter.

- Mobile has been strong, as well, driving search and apps usage.

- Chrome is also growing well and the company said "technical innovation and performance," as well as security relative to other browsers, has made it attractive to users.

By the numbers:

- Google-owned sites generated revenues of $4.44 billion, or 66% of total revenues, in the quarter. That's a 20 percent jump over the year-ago quarter.

- Google’s partner sites generated revenues, through AdSense programs, of $2.04 billion, or 30% of total revenues. This represents a 24% jump from a year ago.

- International revenues were $3.58 billion, or 53% of total revenues.

- Traffic Acquisition Costs, the portion of revenues shared with Google’s partners, increased to $1.71 billion, up from $1.44 billion a year ago. TAC, as a percentage of ad revenues, was 26%, down from 27% a year ago.

- At the end of the quarter, the company had $26.5 billion in cash and cash equivalents.

Shares of Google were up slightly in regular trading, closing at $595.30. Shares were down about 4 percent in after-hours trading.