IBM reclaims server market share revenue crown in Q4, says Gartner

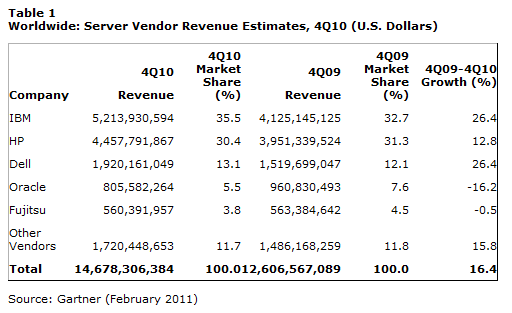

IBM handily claimed the server market share lead in the fourth quarter as the company rode its new mainframe and Power7 systems, according to Gartner. Overall, fourth quarter server revenue was up 16.4 percent from a year ago.

In the fourth quarter a year ago, IBM and HP were in a virtual tie in terms of server market share based on revenue. HP lost market share in the fourth quarter as IBM and Dell gained. Oracle took the largest market share hit in the fourth quarter as the company focuses on higher end systems.

Gartner said pent-up server demand fueled results. Overall, server sales delivered solid growth in the fourth quarter as the data center upgrade cycle continued.

Add it up and IBM grabbed 35.5 percent of server market share courtesy of a 2.8 point share gain. IBM has claimed that it is poaching share from both Hewlett-Packard and Oracle. The company moved 650 Oracle and HP customers over to IBM servers in the fourth quarter and 1,200 migrations for 2010.

The majority of those migrations were from legacy Sun Unix gear.

Here's a look at the standings based on revenue:

In terms of units, HP is in the lead.

For 2010, HP and IBM remained in a virtual tie.

Here's what Gartner said about 2011. In a nutshell, IBM and HP will continue to duke it out.

The outlook for 2011 suggests that growth will continue, but at lower levels, because the highest level of the replacement cycle for x86 servers was probably reached in 2010. These increases continue to be buffered by the use of x86 server virtualization to consolidate physical machines as they are replaced.

HP and IBM are tussling for outright market leadership as both vendors achieved revenues of over $15 billion for 2010, both with a market share of 31 percent. HP achieved a stronger year on year growth rate of 18.9 percent to IBM’s 9.2 percent. HP has demonstrated strength with the results of its x86 ProLiant line all year, although IBM’s System Z line was key in its improved results in the fourth quarter. 2011 will be a critical year in determining which of the relative strengths of these two leading vendors are best aligned to the market direction.