Intel: The industry is 'resetting;' Quarter weak; Inventory swells

Updated: How bad is business in the PC industry? Intel reported a dreadful fourth quarter and CEO Paul Otellini told analysts on a conference call that it was "only the second time in 20 years where revenues declined in the fourth quarter from third quarter. Last time was 2000." Nevertheless, Otellini said the company is forging ahead with its product plans in anticipation of a rebound and plans to manage inventory aggressively.

As expected Intel's fourth quarter was a downer. Meanwhile, the company indicated that the first quarter will also be weak with revenue "in the vicinity of $7 billion." That first quarter revenue outlook isn't official guidance, but is a sum Intel is using for internal planning.

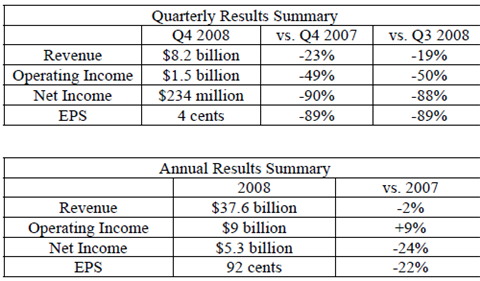

Intel (statement, PDF) reported net income of $234 million, or 4 cents a share, on revenue of $8.2 billion. That figure includes a charge to account for the value of its Clearwire investment.

The chip giant's quarter wasn't a surprise following two warnings. Earlier this month, Intel said that revenue would be about $8.2 billion. In November, Intel was projecting revenue of more than $10 billion. Simply put, the fourth quarter was a disaster from the start. CFO Stacy Smith said that Intel plans to take another $700 million out of the company's costs in 2009 to better weather the downturn.

In a statement, Otellini said:

“The economy and the industry are in the process of resetting to a new baseline from which growth will resume. While the environment is uncertain, our fundamental business strategies are more focused than ever. Intel will continue to extend its manufacturing leadership, drive product innovation, develop new markets and implement operating efficiencies that have already taken more than $3 billion out of our ongoing cost structure since 2006. Intel has weathered difficult times in the past, and we know what needs to be done to drive our success moving forward.”

The big question is when this economic resetting will happen. Intel didn't provide specific revenue targets, other than the "vicinity of $7 billion" mention. Wall Street was expecting revenue of $7.2 billion or so.

Meanwhile, gross margins will decline to the low 40s as it starts up a new manufacturing process. As for the first quarter outlook, Intel added that spending will be about $2.5 billion. For the full year, capital spending will be flat to slightly down for 2008 with R&D spending of about $5.4 billion.

So what went wrong?

A look at Intel's fourth quarter figures tell the tale. For starters, chip and chipset units were "significantly lower" than the third quarter, but average selling prices were flat. Selling prices were higher if you exclude Atom shipments. Fourth quarter gross margin was 53.1 percent, lower than 58.9 percent in the third quarter.

In a nutshell, Intel was whacked by a demand shutdown that led to high inventory and factory underutilization. Pricing wasn't an issue since rivals like AMD were also whacked. Indeed, fourth quarter inventory was $3.74 billion, up from $3.39 billion in the third quarter and $3.37 billion in the year ago fourth quarter. Work in progress and finished goods showed the biggest jump. That's another sign that demand dried up. Now Intel will have to work off that inventory.

By the numbers:

- By geography Intel saw weak revenue across the board. Only Japan revenue held up--sort of.

- The digital enterprise unit (think server chips) had operating income of $1.2 billion on revenue of $4.5 billion. In the fourth quarter a year ago, Intel's digital enterprise unit had operating income of $2.18 billion on revenue of $5.96 billion.

- The mobility group (think Atom, notebooks) had operating income of $933 million on revenue of $3.5 billion, down from operating income of $1.68 billion on revenue of $4.1 billion.

- Intel ended the fourth quarter with 83,900 employees down from 86,300 workers a year ago.

Odds and ends from the conference call:

- The big difference between the downturns of today and 2000? Intel executives said that the first quarter is likely to be in the trough largely because the worldwide supply chain is more able to rapidly adjust to demand and inventory.

- Otellini said that netbooks aren't cannibalizing notebook sales. He acknowledged some cannibalization, but not much.

- Otellini said that pricing for Intel is solid. "We're getting good value for our products," he said. Otellini added that Intel hasn't had to react to external developments.

- Was there strength in servers? Executives were asked why the digital enterprise unit was down roughly 10 percent, which is actually good in this market. Smith said that pricing held well due to new products.

- Smith said it is cutting back production at its factories due to inventory corrections. Intel is trying to correct an inventory glut and hopes to be done by the second quarter with improvement in the second half, said Smith.

- Intel's inventory correction is "tough to call" in terms of dollars because demand is a wild card.

- Atom will grow "substantially" in 2009, but Intel executives declined to say how growth would be assuming the economy was normal.

- Intel and its supply chain were caught flat-footed by the decline in demand. Otellini noted that partners wouldn't have bought parts from Intel if they thought demand would have fallen off a cliff.

- Otellini said that Chinese New Year may help the inventory glut. Factories will shut down and that will help. The supply chain had already slammed the brakes in December.