Microsoft: Yahoo 'unrealistic'; Deadline stands; Quarter mixed

Update: Microsoft CFO Christopher Liddell said Thursday that Yahoo had "unrealistic expectations" about the price it could fetch and reiterated the software giant could walk away from the deal.

Liddell's comments came on Microsoft's third quarter earnings conference call (for live coverage see News.com and Silicon Alley Insider). In a nutshell, Liddell said:

- Microsoft's Saturday deadline to bring Yahoo to the negotiating table stands. If Yahoo doesn't play ball, Liddell said Microsoft will "reconsider our options." He added that one of those options is walking away.

- Liddell said that Microsoft would forge ahead with its online advertising ambitions with or without Yahoo.

- And the CFO reiterated that Microsoft's offer of $31 a share is "extremely generous" and that the company will remain disciplined about its offer. Liddell said that Microsoft's bid was at $31 a share was designed to close a deal quickly. In fact, Liddell noted that the argument that Microsoft should raise its bid because it can "is not one I favor."

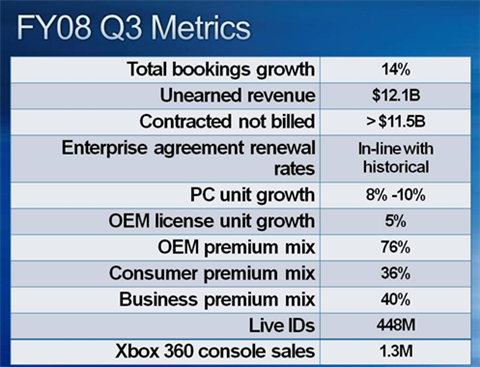

Liddell's comments come amid a mixed quarter for Microsoft. The software giant's fiscal third quarter earnings topped Wall Street estimates, but the outlook for the June quarter was mixed. Client revenue was below expectations in the quarter but Liddell did note that the mix of sales was shifting in favor of Vista over XP. Liddell, who noted that the software spending was mixed, was pressed about the company's outlook repeatedly in the question and answer session.

Here's the earnings rundown (Techmeme, statement, company presentation, preview): Microsoft's reported operating income of $4.41 billion, or 47 cents a share, on revenue of $14.45 billion. According to Thomson Financial, Microsoft was expected to report fiscal third quarter earnings of 44 cents a share with sales of $14.5 billion. However, those earnings figures include a charge of $1.42 billion, or 15 cents a share, to cover an EU fine. But that charge was offset by an income tax reduction.

Add it up and Microsoft's earnings were better than expected, but sales were a bit light.

The outlook was also mixed. Microsoft projected fiscal fourth quarter revenue of $15.5 billion to $15.8 billion with earnings between 45 cents a share and 48 cents a share. Wall Street was expecting earnings of 48 cents a share with sales of $15.5 billion.

Microsoft also unveiled fiscal 2009 guidance. The company projected revenue of $66.9 billion to $68 billion with earnings of $2.13 a share to $2.19 a share. Wall Street is expecting fiscal 2009 earnings of $2.10 a share on revenue of $66.5 billion.

Also see: Does Microsoft CEO Steve Ballmer need an intervention?

The theme in Microsoft's guidance: Earnings lower and sales higher. On the conference call with analysts, Liddell said Microsoft remains confident about IT demand and its business model. Nevertheless, these results raise a few questions: Was Microsoft distracted with the Yahoo bid? Is the perception of Vista hurting demand? Will Microsoft's online unit turn a profit anytime soon?Here's a look at Microsoft's results by division:

By the numbers:

- Client revenue (Vista, XP) was $4.02 billion, down from $5.27 billion a year ago. Deutsche Bank analyst Todd Raker was projecting revenue of $4.3 billion. Operating income was $3.1 billion, down from $4.2 billion. The client unit had a tough comparison given the bump Microsoft got from the Vista launch a year ago. Microsoft's third quarter a year ago included $1.64 billion of revenue deferred from December due to the company's technology guarantee program leading up to the Vista launch. Microsoft said 140 million Vista licenses have been sold to date.

- Server and Tools revenue was $3.25 billion, up from $2.75 billion a year ago. Operating income was $1.1 billion, up from $911 million a year ago. Raker's estimate was $3.2 billion.

- Online services business (MSN) revenue was $843 million, up from $603 million. But the division lost more money than a year ago. The online unit reported an operating loss of $228 million, up from $171 million a year ago. Raker's revenue estimate for the unit was $903 million.

- Microsoft's business division (Office) had revenue of $4.75 billion, down from $4.83 billion. Operating income was $3.1 billion, down from $3.4 billion a year ago.

- The entertainment and device division (Xbox) posted a small operating profit of $89 million on revenue of $1.57 billion. Microsoft's Xbox sold well enabling the division to top its revenue target. Cumulative console sales topped 19 million during the quarter, up 74 percent from a year ago.

- Research and development spending was $2 billion in the fiscal third quarter, up from $1.75 billion.

- Microsoft had total cash, cash equivalents and short-term investments of $26.3 billion.