Microsoft's client revenue skids; Blame netbooks, Windows 7 deferrals

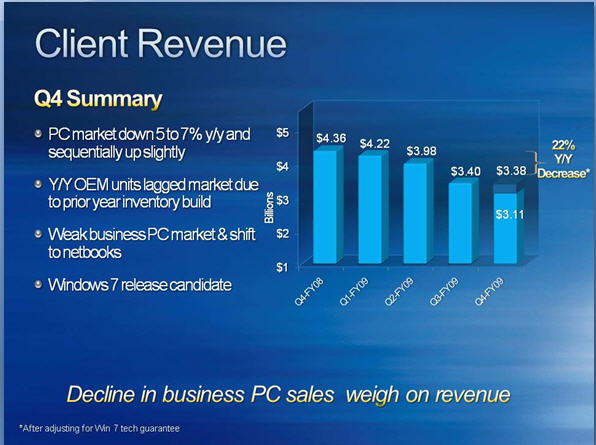

Microsoft's fourth quarter earnings were better than expectations excluding items, but the software giant's client (Windows) revenue skidded 29 percent compared to a year ago. For the three months ended June 30, Microsoft's client revenue was $3.1 billion, down from $4.36 billion a year ago. That slide in Windows revenue led to a quarterly sales shortfall of more than $1 billion relative to Wall Street estimates.

What's going on? More netbooks are being sold and that's hurting Microsoft's pricing power. PC demand isn't so hot either. The refrain: Microsoft saw soft demand for its premium lines.

Wall Street was expecting earnings of 36 a share on revenue of $14.37 billion. On a conference call, Microsoft CFO Chris Liddell said:

We don't expect conditions to improve much, but we don't expect them to worsen either.

But the client revenue was the real headline. Microsoft explained it this way:

Client revenue decreased primarily as a result of PC market weakness, especially PCs sold to businesses, and a 13 percentage point decline in the OEM premium mix to 59%. Revenue growth from Windows operating systems was also impacted by a $276 million deferral for the Windows 7 Upgrade Option program. OEM revenue decreased $1.1 billion or 31%, while OEM license units decreased 10%. Based on our estimates, total worldwide PC shipments from all sources declined approximately 5% to 7%, driven by decreased demand in emerging and developed markets.

This slide says it all:

To put some perspective on Microsoft's client revenue, Deutsche Bank analyst Todd Raker was expecting Windows to generate revenue of $3.61 billion, down 17.5 percent from a year ago. Even factoring in the Windows 7 upgrade program Microsoft missed the client revenue mark.

Analysts had become more upbeat about Microsoft's client revenue following positive PC unit data and Intel's results. However, when those units are netbooks Microsoft has problems. What's good for Intel isn't good for Microsoft these days. In addition, Vista has played out so Microsoft is in limbo until Windows 7 launches.

Liddell said that "business continued to be negatively impacted by weakness in the global PC and server markets."

A few more key points from Liddell:

- Business was disproportionately bad relative to weak PC demand. Higher average selling price won't come back until business demand returns.

- Microsoft would buy back shares if there were a confident bottom in market.

- Microsoft has "little potential to lower expenses for the rest of the year."

For the year, Microsoft reported net income of $14.57 billion, or $1.62 a share, on revenue of $58.44 billion. Sales were down 3 percent from a year ago and net income fell 18 percent.

As for the outlook, Microsoft only said that its expenses would be $26.6 billion to $26.9 billion for fiscal 2010.

Here's the breakdown of Microsoft's results by business unit and my notes:

Odds and ends worth noting:

- Online ad revenue was down 14 percent for Microsoft.

- Server and tools revenue was hit by the fall in server sales.

- The business division (Office, SharePoint and CRM) held nicely. CRM hit 1 million seats and Sharepoint revenue grew at a double-digit clip. Microsoft says: "Consumer revenue decreased $289 million or 30%, primarily as a result of PC market weakness, a shift to lower-priced products, and pricing promotions on the 2007 Microsoft Office system."

- The company ended the quarter with $6.07 billion in cash and equivalents and $25 billion in short-term investments.