Microsoft's third quarter: Office, Kinect pick up Windows slack

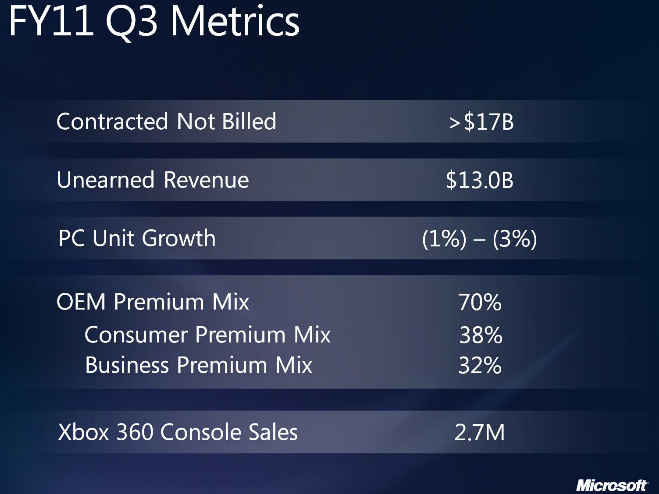

Microsoft reported solid fiscal third quarter results as revenue topped estimates, but the software giant said the PC market was "mixed."

The company on Thursday reported fiscal third quarter earnings of $5.23 billion, or 61 cents a share, on revenue of $16.43 billion, up 13 percent from a year ago. However, those earnings got a 5 cents a share boost due to a tax benefit. Strip out the tax gain and Microsoft came in at 56 cents a share, in line with Wall Street estimates.

But given the concerns about a weaker than expected PC market, Microsoft quarter turned out well. In a statement, Peter Klein, Microsoft CFO, said that the quarter demonstrated the company's "breadth of our businesses."

As for the outlook, Microsoft reaffirmed its fiscal 2011 outlook for its operating expenses.

Microsoft added the following color to its outlook.

- For fiscal 2011, it expects the Windows unit to be in line with PC market growth. For fiscal 2012, Microsoft expects the corporate PC upgrade cycle to continue to outpace consumer demand.

- The business division will see Office sales exceed PC demand in fiscal 2011, but then have tough comparisons in 2012.

- Servers and tool revenue will track the hardware market and Microsoft expects to grow faster than the server market in fiscal 2012.

- Online services revenue will track the online ad market, but in fiscal 2012 Microsoft expects Bing's revenue per search metrics to improve.

- The entertainment and devices unit will see revenue growth of 25 percent in fiscal 2011 and 2012 will feature more momentum. Microsoft teased "more to be shared at E3 in June."

Indeed, Microsoft showed strong gains in Office 2010, Xbox and Kinect as well as servers and tools.

By the numbers:

- Microsoft's R&D spending was $2.27 billion in the third quarter, up from $2.22 billion a year ago.

- The Windows and Windows Live unit reported third quarter operating income of $2.76 billion on revenue of $4.44 billion. That was down from operating income of $3.07 billion on revenue of $4.65 billion a year ago.

- Server and tools delivered operating income of $1.42 billion on revenue of $4.1 billion. The online services unit continues to lose money with a third quarter operating loss of $726 million on revenue of $648 million.

- Microsoft's business division reported operating income of $3.16 billion on revenue of $5.25 billion.

- The entertainment and devices division reported operating income of $225 million on revenue of $1.93 billion.