Mobile wallet wars: Bet on the established financial, billing players

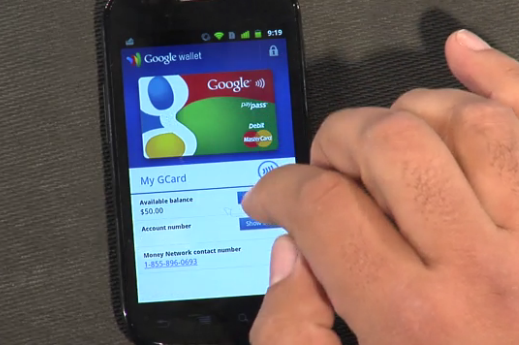

When it comes to mobile wallets, the dream is that consumers will use smartphones as their primary payment mechanism. You tap. You pay. These wallets will be so handy that all of your cards---Visa, Amex, Mastercard and loyalty clubs---will be stored in them.

Meanwhile, banks, financial institutions and payment networks such as Visa, Discover, Mastercard and American Express will also be in on the act. The mobile carriers---AT&T, Verizon Wireless and T-Mobile are also reportedly investing $100 million into ISIS, a partnership that aims to create mobile wallets.

What side will win? My bet is on the established players. They have the leverage, consumer familiarity and trust already. More importantly, there are billing relationships. It's an interesting dance between these sides. As CNET News' Maggie Reardon noted, Visa and Google compete, but don't really acknowledge that they are rivals.

Nevertheless, tech players may get the press, but my wallet is likely to be stored with the same institutions I already have relationships with.

My mobile wallet pecking order goes like this.

- Banks (established relationships).

- Transaction networks (Visa, Amex etc).

- Companies that have your financial data already (mobile carriers, PayPal, Apple).

- Outsiders looking to disrupt (Google).

All of these wallets are likely to be open. From there, the game comes down to trust and brand.

With that backdrop in mind, we spoke with Bill Gajda, head of Visa Mobile, recently. Here's a look at the highlights of our conversation and my take:

Potential competition from startups and other tech players such as Google. Gajda said that the startups that he watches for partnerships and possible investments "innovate on the edge of the ecosystem." Disrupting a financial system that has been established for 50 years is difficult for startups. As result, the successful companies are likely to work with the system and innovate on the edge of that backbone. Square fits that profile, said Gajda.

My take: I agree with Gajda's view of the landscape even though Visa could be viewed as any incumbent that doesn't see the small fry coming. The reality is that it's tough to upend a well-honed financial system.

What about PayPal? Gajda considers PayPal a competitor and customer. "PayPal is a huge customer and a lot of those accounts are loaded via Visa," said Gajda. On the other hand, PayPal will compete at the retail point-of-sale terminal. Couldn't PayPal be a mobile wallet of choice? Sure, but scale matters argues Gajda and PayPal's 90 million or so accounts are dwarfed by Visa's 1.6 billion cards in the field.

My take: I see eBay and PayPal as more of a threat than Gajda. PayPal will have a different spin, but if the payment system does become a big option at the retail terminals Visa fees will suffer.

What's are the keys to the wallet wars? The biggest key is that wallets have to be open and offer functionality. Visa is looking to be a wallet player as well as be the network that operates in the background. Gajda also argues that trust matters a lot---consumers are likely to stick with the banks and financial partners they know.

My take: I agree with the trust argument. I'm not going to house my data with just anyone even if the security is top notch. I'd argue Google, Microsoft and any other tech provider will ultimately be on the outside looking in.

Is Near Field Communications (NFC) the enabler? Gajda said that NFC devices will be a key enabler for mobile wallets over the next two to three years. "There will be millions of devices with NFC," he said.

My take: Visa has dangled lots of carrots and sticks to get retailers on board with NFC at some point. I'd be more comfortable with a five-year timeline to mobile wallet utopia.

How's Visa's model going to evolve? Today, Visa is a transaction network, but going forward the company will provide real-time offers, alerts and other tools to consumers. Visa and Gap have teamed up for real-time coupons under a program dubbed Gap Mobile For You. With its network, Visa can see relevance---it knows where you are and what you bought---as well as fulfillment of an offer. Couple those items with location and Visa makes Groupon look like a blunt instrument swinging wildly as it hopes to land a consumer. Visa will either be a white-label provider of these services or be more outfront.

My take: Visa has the IT systems, visibility and network to be the go-to coupon and offer outlet. No one short of Amex, Discover and Mastercard can match the visibility and data Visa has on a customer.

What are the risks to the Visa as Groupon effort? Gajda noted that Visa has been more of a distributor and network provider than a business partner. That role has to change. Visa will be seen as both and enabler and a brands. "Mobile gets us closer to the consumer," said Gajda.

My take: The largest question here is what Visa means as a brand to consumers. We'll find out soon enough when Visa's mobile wallet lands. When it comes to brand, Google has more heft. I'd argue that financial transactions are different than an email account.

Related: