Mortgage upheaval could ding online advertising

The mortgage industry is in a shambles as the credit market unravels amid bad subprime mortgages. That's part of the reason why the stock market has been plunging of late.

What does that development have to do with online advertising? Potentially a lot.

Nielsen/Netratings delivered its July traffic recap on Thursday and while the headline focused on social networking and other blogger buzzwords my eye went right to the advertiser rankings.

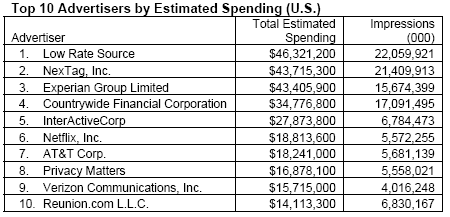

The top spender on advertising is a mortgage referral company Low Rate Source (woops). The third ranked company is credit rating firm Experian (may actually do better because if your credit rating isn't pristine you're not getting a mortgage). And the fourth ranked advertiser was Countrywide Financial, which just tapped its credit line because mortgage liquidity is drying up. Countrywide is a lock to cut spending and its online advertising budget. And you can't peruse Yahoo Finance or Google Finance without getting a mortgage pitch somewhere.

InterActive Corp. is the fifth ranked advertiser and it's a safe to bet that some of that advertising directs folks to LendingTree, which also refers folks to lenders.

And if this mortgage fiasco spreads to consumer spending perhaps comparison shopping service NexTag doesn't do as well. NexTag is the second largest advertiser. Add those sums up and you have a significant number.

The point: Online advertising isn't as insulated as we think. Meanwhile, there are a lot of keywords being bought by those aforementioned companies. Watch the language from Google, Microsoft or Yahoo to monitor the fallout.