Motorola's mobile device revenue tanks in fourth quarter

Motorola's fourth quarter results were in line with Wall Street's dismal expectations. That's where the good news ended.

Motorola reported a net loss of $3.6 billion, or $1.57 a share, on revenue of $7.1 billion (statement, Techmeme). The loss was the result of a charge of $1.56 a share. Back that charge out and Motorola lost a penny a share, in line with estimates.

However, Motorola also suspended its dividend to save cash and tossed chief financial officer Paul Liska. He will be replaced by Edward Fitzpatrick, senior vice president and corporate controller on an interim basis.

Motorola didn't provide a reason for Liska's departure, but it's fairly obvious the numbers stink:

Total revenue fell to $7.1 billion from $9.6 billion in the fourth quarter a year ago.

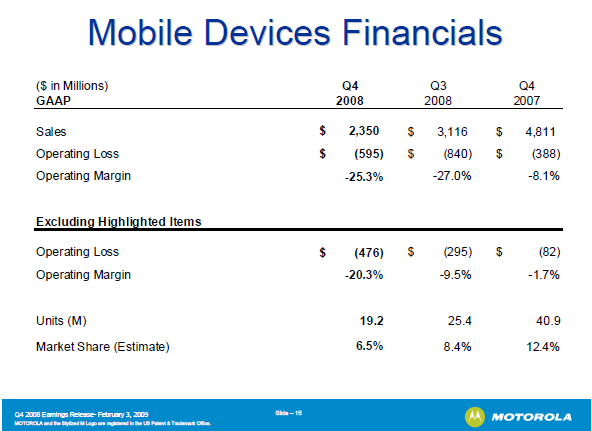

- Fourth quarter mobile device revenue was halved to $2.35 billion from $4.81 billion a year ago. The mobile device unit had an operating loss of $595 million.

- Home networks and mobility revenue was $2.59 billion, down from $2.7 billion. This unit makes DVRs, HD and IPTV set-top boxes as well as 4G technologies.

- Enterprise mobility revenue showed a slight gain with fourth quarter revenue of $2.2 billion, up from $2.14 billion a year ago.

Add it up and Motorola is a tale of two companies: A mobile handset division that is too sick to spin off as planned and the rest of the business, which is solid.

The big question is whether Motorola can fix the mobile business so it doesn't infect the rest of the company. Motorola has been cutting costs aggressively in any attempt to save $1.5 billion in 2009. One mission for Motorola should be to simplify its mobile handset portfolio.

Motorola expects to lose 10 cents a share to 12 cents a share, excluding charges, in the first quarter. Wall Street was expecting a loss of 6 cents a share.