Nuance Q2 propelled by healthcare, enterprise

Nuance Communications, a voice recognition software company, reported a strong second quarter courtesy of strong demand from its healthcare and enterprise units.

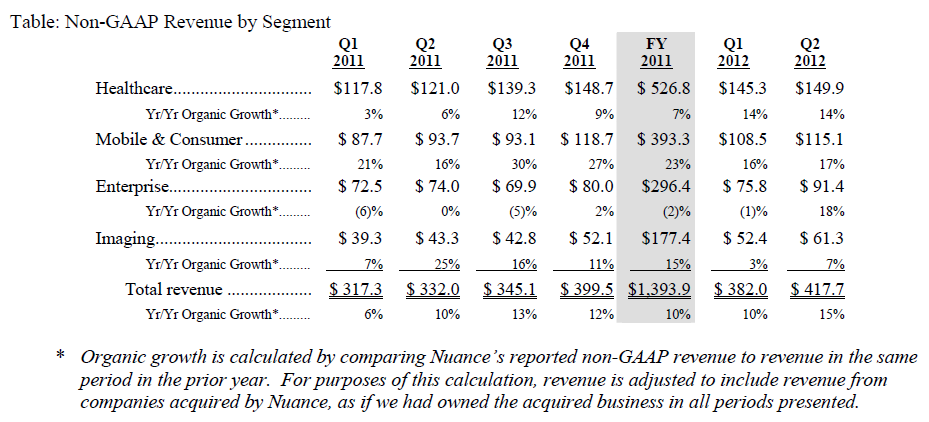

The company reported second quarter earnings of $900,000, or break even on a per share basis, on revenue of $390.3 million, up 22.4 percent. Non-GAAP revenue was $417.7 million with non-GAAP earnings of 43 cents a share. Wall Street was looking for non-GAAP earnings of 41 cents a share on revenue of $412.6 million.

Healthcare non-GAAP revenue for Nuance in the second quarter was $149.9 million, up 23.9 percent from a year ago. Mobile and consumer non-GAAP sales jumped 22.8 percent to $115.1 million in the second quarter. Enterprise sales on a non-GAAP basis checked in at $91.4 million, up 23.5 percent from a year ago. Nuance counted AT&T, Cigna, Comcast, Time Warner and Deutsch Bank as key wins.

As for the outlook, Nuance said that its second quarter growth should continue into the second half. Nuance added that mobile and consumer sales should be strong in the second half as it deploys virtual assistant services.

The company projected third quarter non-GAAP revenue to be between $430 million and $447 million. Non-GAAP second quarter earnings will be 38 cents to 41 cents a share. Wall Street was looking for earnings of 41 cents a share on revenue of $433.5 billion. Fiscal 2012 non-GAAP revenue will be between $1.72 billion and $1.76 billion with non-GAAP earnings between $1.61 and $1.67 a share. Wall Street was looking for $1.63 a share on revenue of $1.71 billion.