Oracle acquires RightNow for $1.5 billion, aims turrets at Salesforce.com

Oracle's rivalry with Salesforce.com is about to get more interesting. Oracle said Monday that it will acquire RightNow, which is a cloud customer service company, for $1.5 billion, or $43 a share.

RightNow is a software as a service company that focuses on customer service via call centers and self-service options via the Web and social networks. That customer service focus is aimed at the heart of Salesforce.com.

Thomas Kurian, executive vice president of Oracle Development, said in a statement that Oracle is "moving aggressively to offer customers a full range of Cloud Solutions including sales force automation, human resources, talent management, social networking, databases and Java as part of the Oracle Public Cloud."

That quote is basically shorthand for "Oracle is going cloud shopping."

At Oracle OpenWorld, the company outlined plans to get into cloud computing, big data and other efforts such as NoSQL databases. Oracle said its NoSQL database was generally available today.

Cowen analyst Peter Goldmacher said Oracle's purchase of RightNow puts the heat on Salesforce.com. Goldmacher said:

We believe this deal will make it incrementally more challenging for Salesforce.com to sell its Service Cloud offering which it has promoted aggressively for the last year. Customer service management solutions are primarily purchased by larger enterprises, where Oracle has dominant distribution. As Oracle becomes more competitive in this market segment, we expect it will slow down sales cycles and reduce win rates for Salesforce. This slowdown in big deal opportunities/wins will likely put further pressure on Salesforce's sales productivity, as well as pressure its margins.

Gartner analysts argued last week that Oracle will acquire and roll out more cloud capabilities in the next year or two. Judging by Kurian's quote, Oracle could be looking to acquire other players in various cloud niches.

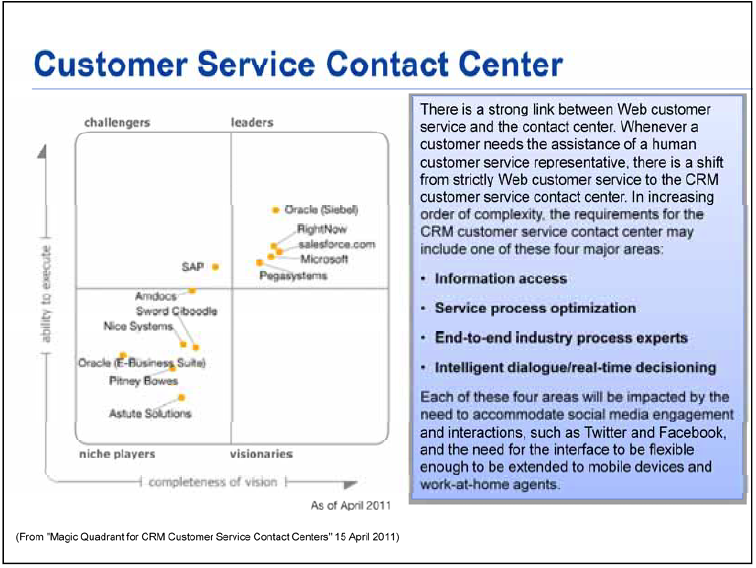

In this acquisition, Oracle is looking to consolidate a leadership role in the call center. Here's Gartner's magic quadrant.

Right time for RightNow?

RightNow's financial profile looks a lot like other SaaS companies. For 2011, RightNow is expected to deliver non-GAAP earnings of 58 cents a share on revenue of $226.7 million. That annual revenue is on par with other SaaS companies with the exception of Salesforce.com, which is on track for more than $2 billion in annual revenue.Oracle's bet is that it can take RightNow and grow it faster via its army of enterprise sales people. Indeed, RightNow's ability to meet demand appears to have been stretched.

In a recent research note, Piper Jaffray analyst Mark Murphy said:

Our checks in the RightNow ecosystem indicate strong business momentum across multiple verticals. All of the industry contacts we interviewed reported ongoing positive trends. Contacts highlighted strong demand momentum driven by an aggressive sales organization as well as increasing interest from large resellers. Contacts alluded to a couple of large deals closed in the quarter and also referred to "impressive up sell" activity across the customer base. Contacts further highlighted that “Q4 is shaping up pretty good” and also mentioned that RightNow's professional services is “stretched and they have a huge backlog.” Call Center/Contact Center replacement spending is strong, driving demand for Cloud-based multi-channel Service products.

Oracle: Playing offense or defense?

The RightNow deal coupled with the purchase of Endeca illustrates how Oracle at first pooh poohs big trends---unstructured data, NoSQL and cloud computing---but then hops on the bandwagon via acquisition.In other words, Oracle will collect the maintenance, but isn't going to let rivals like Salesforce.com sneak up on it. When SaaS becomes too big of a threat, Oracle buys a seat at the table to compete. It's becoming increasingly clear that Oracle is threatened by the cloud movement.

Also see: Enterprise IT and megavendors: Cloud players angle in on bad marriages

The big question is what cloud acquisitions are next on the radar. Here's a short list of possibilities based on Kurian's quote:

- SuccessFactors: A play on human resources that may be pricey for Oracle, but worth doing given SuccessFactor's large base of customers for talent management. Taleo would also be a logical candidate.

- Jive Software: Oracle has some social hooks into its products, but Jive would be an acquisition to step things up a bit. For Jive, Oracle may make a good partner given Salesforce.com's effort to make Chatter a social enterprise standard. Yammer would be another option.

- NetSuite: Technically, NetSuite isn't dangerous enough to Oracle just yet, but Larry Ellison already owns about half of the company. As NetSuite grows, it's increasingly likely that it will be brought into the Oracle fold.

Related: