Palmisano outlines IBM's 2015 roadmap; Earnings to double; Consumerization mocked

IBM CEO Sam Palmisano doesn't talk publicly all that often, but when he brings a little heat. Palmisano said the company will deliver earnings of at least $20 a share in 2015 and generate $100 billion in cash flow between now and then. IBM will also spend $20 billion on its acquisitions between 2011 and 2015. He also mocked the fashionable view that consumer technology will dominate the enterprise.

Palmisano, speaking during IBM's investor day Wednesday, almost seems to relish the fact that IBM may not be all that fashionable. He noted his view is decidedly East Coast, but it's a bit hard to argue with IBM's results. Palmisano also thanked Oracle CEO Larry Ellison for saying he wanted his company to be like T.J. Watson's IBM. "He got the timeline wrong, but we'll take the compliment. We don't get many from the West Coast," said Palmisano.

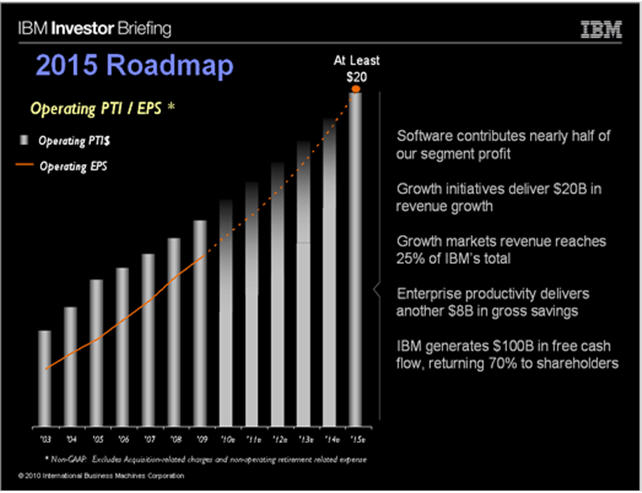

A few years ago, IBM laid out that it would deliver earnings of at least $10 a share or so and garnered a few doubters. Big Blue handily topped those targets. Palmisano recapped the story most of us know too well. IBM ditched businesses that didn't grow, doubled down on software and services and bet big on analytics. Big Blue will take the current model and accelerate it.

"IBM will be as dramatically different as IBM is today as when we talked about it in 2003 and 2004," said Palmisano. The financial roadmap looks like this:

But more interesting was Palmisano's take on the current consensus view of from technology's chattering class. Palmisano urged shareholders to look below the surface on the consensus view. He said that it doesn't make sense to confuse volume of the chatter with results. The consensus view today goes like this:

Product cycles will drive industry growth. The industry is consolidating and at the end of the day consumer technology will obliterate all computer science over the last 20 years.

The reality according to Palmisano goes like this:

I'm an East Coast guy. We're going to have a slightly different view. Product cycles aren't going to drive sustainable growth. Clients in the future will demand quantifiable returns on their investment. They are not going to buy fashion and trends.

On consolidation he said:

Is [the industry] really consolidating or are they late to respond to trends? Is it truly consolidation or just a trend when they late to the party. Try and get below the surface instead of the volume of things.

On consumerization, Palmisano said:

Enterprise will have its own unique model. You can't do what we're doing in a cloud.

Palmisano then quipped that his view of the future "didn't need a McKinsey study or anything."

Other key items:

- In emerging markets, the middle class is emerging. When the middle class emerges you build infrastructure. "That creates a lot of demand for the types of things we do," said Palmisano. Emerging markets will become a larger part of the revenue base.

- On acquisitions, Palmisano said IBM isn't looking to be a holding company for all IT. Palmisano will spend $20 billion on acquisitions through 2015. Software, analytics and software as a services will be sweet spots. Related: Watch IBM's Cast Iron acquisition closely: SaaS integration in play

- "We take assets and globalize them," said Palmisano. "We will not chase things that are commoditizing." Later, IBM CFO Mark Loughridge said revenue without margin is a mere distraction. Those comments could be taken as a dig at HP.

- Computing clouds are very relevant, but "they have a place and an appropriate use. It's not all of the environment."

Related: IBM posts solid first quarter; Sees IT spending rebound across categories