Pondering Google 2.0: How will it get to $100 billion in revenue?

Google is projected by Wall Street to have annual revenue of $15.7 billion in 2008 and $19 billion in 2009. But the ambitions are higher--more like $100 billion in annual revenue. The big question: How will Google get there?

That question is being addressed in a report by Stephen Arnold, of ArnoldIT. Arnold made the rounds at Bear Stearns providing briefings about his report. In the report, Google 2.0: The Calculating Predator, Arnold analyzed Google's patent pipeline and linked them to business strategies. Simply put, Arnold is trying to figure out what Google wants to be when it grows up.

We haven't read Arnold's report entirely (it'll cost you $640) but enough details have emerged for discussion. We also conducted a brief interview with Arnold to fill in some gaps.

Arnold wrote in the report's preface:

"My main thesis is that Google’s technology is special, and it makes the company a supra-national entity. Soon lawmakers will realize that Google will be challenging to regulate and control. Google’s biggest vulnerabilities are its own management who must prove it is equal to the task of creating a billion dollar company without self-destructing. Meanwhile, competitors, unable to respond technically, are making an effort to crush Google with litigation. "

A few takeaways for discussion:

Extrapolating Google's potential business strategies takes guesswork.

In a brief about his report Arnold wrote the following:

"Traditionally, it has been difficult to get to grips with what Google is. The company is not specifically secretive; rather, it is unforthcoming about its aims, plans, strategies and ambitions. "Provide access to the world's knowledge" is about as focused an articulation of mission as one can get from the Google people. And, from a quick outside perusal, the company seems to dabble in all sorts of technology areas and buy up all sorts of high-tech companies, which makes measuring progress or evaluating strategic orientation somewhat difficult."

Arnold then set forth with a look at Google's patents to try to divine a strategy. He looked at Google's mathematics-based business, a Web-based OS, database patents, tracking technology, text processing and brokering between advertisers.

This discussion quickly puts me in a circular argument. Are Google's potential businesses (and all the patents that go with them) the result of excess capital or some divine strategy? If the answer is yes, is it possible that Google doesn't have this huge strategy beyond selling ads in as many nooks and crannies as it can find? If Google really has this uber strategy wouldn't it have been articulated? A few years ago, an executive knowledgeable of Google said to me that the company often does things just to keep people (notably Microsoft) guessing and on its toes. Those comments come back to me as this Google 2.0 discussion begins.

Will math rule the world?

After an Arnold briefing, Bear Stearns analyst Robert Peck talked of how Google is trying to build a "hypercube." "While Google is attempting to build a 'hypercube,' people generally see only the cube representing search and advertising," wrote Peck in a recent research note. The general idea is that Google is building this Borg-ish thing that no one quite understands. The leap of faith is this: This cube will be big--really big.

This approach has given Google anywhere from a 9 to 24 month technology lead over its competition, said Arnold in an interview. "I don't see much technology competition for them," said Arnold. "If they can avoid fighting among themselves they're good for 15 to 20 years. Just like Microsoft replaced IBM Google is replacing Microsoft."

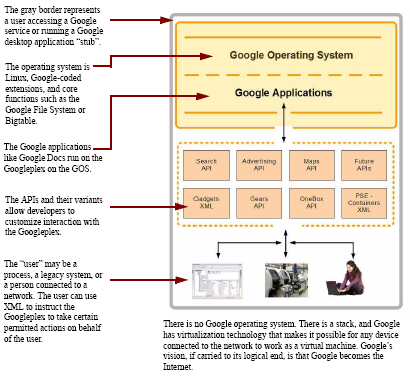

Here's Arnold's diagram outlining Google's better mousetrap.

Arnold in his brief about the report said Google boils down to arithmetic. In one passage Arnold wrote:"Google is a company of engineers and mathematicians, not a company of sales, promotion and legal wizards. Mathematics is the foundation of Google's wizardry and, as analyzed by Arnold in this new study, the Googleplex is a wondrous construct that gives Google a major competitive advantage in a wide variety of possible fields: enterprise services and computing, web and enterprise search, publishing, banking, advertising, telecommunications. The Googleplex can crunch, analyze and extrapolate rapidly, intelligently and economically from extremely large quantities of data. The owners of such a machine can test and probe a variety of markets, and their existing base income from advertising gives them billions of dollars to use in their probes and explorations."

In a press release, Arnold said:

"Google has superb engineers, but it has better mathematicians than any of its competitors. Math makes a crucial difference in how Google operates and how it delivers certain services better, faster, and more economically than its competitors at this time."

Arnold continued:

"Google is perhaps today’s best example of a company built on calculative thinking. Characteristics of calculative thinking include efficiency and logic, not emotional reactions. An elegant proof of a theorem bundles intelligence and beauty into a construct of great beauty. Google obviously needs revenue to expand; therefore, markets with inefficiencies that can be made more efficient with Google technology are logical targets. Analog telecommunications companies, for example, become prey to Google’s more efficient technology. Like a grand master in chess, Google uses strategic feints to obtain its objective—winning the game."

Will Google dominate the world due to its math prowess? I'm skeptical and here's why: Quantitative black boxes can blow up. In fact, quantitative hedge funds are blowing up all over the place. These guys--astrophysics types managing money--thought they had risk licked. The stock market begged to differ.

Now let's extrapolate that event to business strategy. Google may be wondrous and able to boil everything down to an algorithm. The problem: Business is based on human interaction. Sales, promotion and legal stuff matters. Emotional intelligence matters. Good management matters. Are Google's algorithms infallible? Today, it sure doesn't seem like it. Long term, everything is fallible. It's telling that Google's math skills have scared as many partners as they have landed.

Google's big initiatives bring big competition.

Peck summed up Arnold's report as the following:

"An analysis of Google's patents suggests there are six areas Google may be focusing on, including telecom (looking at wireless applications, including search-without-a-search, relationships with KDDI, Sprint, Apple, talk of 700 MHz bid), entertainment (online video), publishing (in a position to disintermediate publishers), enterprise applications, e-payments (poised to become a transaction/exchange environment on top of CheckOut), and next-gen advertising (multimedia ad widget that can be delivered on any platform)."

For those following Google closely none of those business strategies are news. But it is very early in the game. Have Google's radio and print efforts yielded much yet? How about its nascent TV ad efforts? And enterprise applications? Most folks have Microsoft Office. Wireless hasn't played out at all yet. E-payments? eBay's PayPal is formidable. Of those key areas, the only slam dunk is widget advertising.

Can Google sell its technology? Sure. Would it be successful? Maybe. Arnold wrote about Google's Bigtable database, which was "designed to overcome the limitations of databases now available from IBM, Microsoft, and Oracle." Sounds very interesting. But to be a business Google would have a tough time usurping the big database vendors.

So how will this play out? I followed up with Arnold on his views about Google tackling new markets. The big question focused on how much of a stretch was the $100 billion in revenue target. Arnold argues it's not a massive stretch. He reckoned that each of those six primary markets along with Google's organic could represent $30 billion in revenue. Using that logic, Google would only have to be successful at two of those six new markets to get to $100 billion in revenue in a few years.

"There are six areas of focus for Google and each area is good for $30 billion in revenue. If Google knocks off two of the six it will be in the $100 billion range in four fiscal years. By the end of 2010 Google would be in shouting distance of $100 billion in revenue and hit it in 2011," said Arnold.

Bottom line: If Arnold is correct Wall Street is seriously underestimating Google's future revenue.

Another wildcard is whether Google could take its technology, say Bigtable, and turn it into a product. Arnold said it's possible with a few caveats.

"Officially Google would say no when it comes to making Bigtable a product. But it's really a no, maybe. Google may get pulled into something. They will do whatever the clicks tell them," said Arnold.

Arnold explained that Google's product launch would be a pull approach. Say a big partner or government agency asked Google about Bigtable capability. Google would probably do something as a pilot. And Bigtable could evolve into a service. "If it feels good and others ask for it Google would do it," said Arnold.

Execution must be near perfect to get to $100 million in annual revenue.

To tackle those aforementioned big markets, acquire companies at a rapid clip, keep its technology lead and expand into market outside of search and advertising Google will have to execute well. Google's business today is advertising. In the future, new businesses will share that advertising link, but bring new complications.

In many respects, this Google discussion reminds me of Microsoft in the mid-1990s. At that time, Microsoft was assumed to thrive in any market it entered--game consoles, business intelligence, databases, music players etcetera. Microsoft has made inroads in new markets, but hasn't dominated by any stretch.

Can a company grow at such a clip without growing points? Can a company evolve without hitting an awkward adolescent phase? Can Google, which hired too many folks in its most recent quarter, install the processes and people to be nimble even as it becomes a bigger company?

In an interview Arnold acknowledged the math as management hurdle for Google. "Mathematicians are not good at management. That's the number one reason they may fail. Who's your worst enemy? It's you. This is a big issue where Google has to manage the science of management as well as mathematics," said Arnold.

If Google stumbles rivals could close a competitive gap, but it won't be easy. Another point open for discussion: Business strategy worship tends to follow market cap. Cisco's business model was worshipped in 1999 and then the bust happened. Suddenly, there were stories on how Cisco's model wasn't so hot. Today we're loving Cisco again. Pick your company (Dell for instance) and that ebb and flow plays out over time. If Google stumbles in a few years, we'll be reading how a bunch of math wonks led it astray.