Qualcomm buys Atheros for $3.1 billion, moving into 'silicon beyond cellular'

In a move to round out its wireless and networking product portfolio, Qualcomm acquired Atheros for $3.1 billion, or $45 a share. For Qualcomm, the acquisition highlights a strategy to move beyond its traditional cellular market into more mainstream computing.

Word of the deal surfaced on Tuesday via reports on CNBC, the New York Times and the Wall Street Journal.

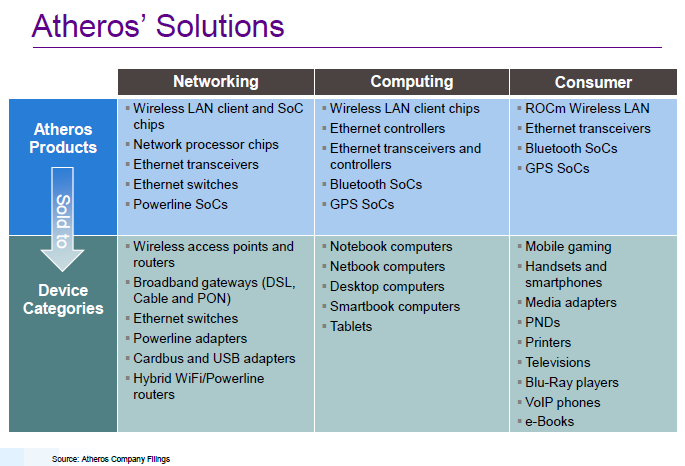

With the Atheros acquisition, Qualcomm gains access to wireless LAN, Ethernet, Bluetooth, GPS, passive optical networking and powerline technologies. Qualcomm will take those products and ultimately integrate them with its smartphone and tablet chips.

Analysts were generally upbeat about Qualcomm's plans. Piper Jaffray analyst Auguste Gus Richard said in a research note that Qualcomm will be positioned well for the "ultramobile era" with the Atheros purchase. Richard argued that Atheros products will integrate well with Qualcomm's Snapdragon chip. In addition, the combination of Qualcomm and Atheros, which is nearing a $1 billion annual revenue run rate, will be better positioned to take on Broadcom or Marvell.

In the smartphone and tablet market, combination processors will be key. The Atheros deal gives Qualcomm more technologies to put into its platform.

Qualcomm CEO Paul Jacobs said on a conference call with analysts that Atheros' technology will help it connect phones with multiple emerging devices such as tablets.

Jacobs said:

This acquisition makes sense on a lot of levels. From a vision standpoint we believe that communications capability will go into more and more devices in the world around us and that the phone will be used to interact with these devices. From a strategy standpoint we will continue to lead in technology through significant R&D investments and this acquisition allows us to profit from those investments across a larger base of devices. From a tactical standpoint we will have access to a strong team and a new set of technologies, partners, and distribution channels and we will also be able to broaden our relationships with existing customers.

Qualcomm executive vice president Steve Mollenkopf added:

Our announcement today is an important step for our business. It is a clear indication of our strategy to move aggressively into silicon beyond cellular. We believe that it will expand our opportunities with new products, new customers, and new sales channels. It will enable us to grow a platform business in additional areas such as consumer electronics, networking, and computing. You have heard us talk about our vision around the convergence of mobility computing and consumer electronics. Our announcements today should be viewed as a statement about our commitment to provide a complete set of solutions to address this trend as it is clearly unfolding in front of us today.

In the big picture, Qualcomm's purchase of Atheros illustrates how the company plans to become more of a platform provider. To Qualcomm, the future of computing is more about tablets and smartphones than the PC. Simply put, Qualcomm will be on a collision course with the likes of Intel.

Mollenkopf added:

First of all, we think that the platform strength of smartphones is really going to generate an enormous pressure on a number of adjacent markets to adopt a similar type technology platform. And you are already starting to see that in the case of tablets where the tablets, instead of using technology which historically may have come from platform technology which may have historically come from the PC world, it is really pulled the phone world up, including bringing technology providers and application suppliers from that world. As we start to drive that strategy, which has been a stated strategy for some time, we start to encounter really two areas that we think are addressed by this acquisition. The first one is that you start to encounter more technology that you need to connect to different things that you need to connect to in the phone. The wireless LAN that you might need to support a platform play in a tablet may be different than what you use for a handset. As we do that we either have to invest in that or we need to partner and so we obviously know which direction we went there. We think there is going to be a lot of momentum in other markets in a lot of places where people are going to want to have that same smartphone experience but throughout their entire daily life. And I think it's going to really require us to add a larger platform of goods and technologies that the Atheros team has.

Atheros CEO Craig Barratt will join Qualcomm as president of networking and connectivity. The deal is expected to close in the first half of 2011.