Rackspace goes for it: Plots infrastructure buildout; Notches enterprise wins

Rackspace is adding cloud and hosting customers at a healthy clip and plopping down the capital spending to go with it. The company upped its 2009 capital expenditure outlook as it builds out its infrastructure and chases enterprise customers.

On Rackspace's second quarter earnings conference call, the company detailed that it will spend $165 million to $185 million on new infrastructure, including a data center buildout. Rackspace had projected capital expenditures to be $120 million to $160 million.

The news (statement) comes amid a quarter that had a little something for everyone. The company reported earnings of $7 million, or 6 cents a share, on revenue of $152 million. Wall Street was expecting earnings of 6 cents a share on revenue of $149 million.

Rackspace CEO Lanham Napier said on a conference call that the company is positioning itself for the next phase of growth. On the enterprise front, Napier noted that Rackspace is landing more complicated deployments. "We're seeing the opportunity in enterprise and that opportunity will continue to be there," said Napier, who noted that customers are more confident. IT spending isn't about to grow yet, but "there are some encouraging signs," said Napier.

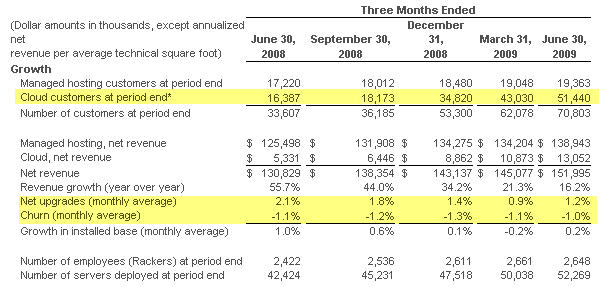

Here's the breakdown of the quarter:

Positives:

- Rackspace's total customer count in the second quarter was 70,803, up from 62,078 in the first quarter.

- Of that sum, 51,440 were cloud computing customers. Cloud hosting revenue was up about 145 percent year over year for the second consecutive quarter.

- Churn was 1 percent for the quarter ending June 30. That tally is Rackspace's best rate in the last five quarters.

Negatives:

- Rackspace paid $2.4 million in service credits related to a data center outage in June.

- Capital spending will be up significantly from previous estimates.

- Rackspace had 177,371 technical square feet of data center space at the end of the quarter with a utilization rate of 59.8 percent, down from 64.6 percent. Revenue per technical square foot was $3,631, down from $3,969 in the first quarter.

- Profit margins are likely to take a hit as Rackspace expands.

What you have here is a company that is ramping up for future growth. That fact is good news and bad. If the demand arrives, Rackspace will be ready. If the demand isn't there, Rackspace is stuck with too much capacity. On Wall Street, this angst over capital spending occurs often among investors. Wall Street fretted over capital spending when Verizon built out its FiOS network, when Amazon built up its fulfillment capabilities and when Omniture scaled up two years ago. Only companies that make gobs of money---Google for instance---mostly elude this angst.

Also see: Rackspace lays out its cloud computing roadmap: Think hybrid

Given that angst the next item to ponder is whether Rackspace will see cloud computing continue to surge. Seems to me that the Rackspace buildout is justified, but the angst is understandable---especially if the company needs to raise more capital.

JMP Securities analysts Patrick Walravens notes that these arguments can be contentious. Bulls view capital expenditures as a sign of future growth and demand. The bears see money being spent in a bet that may not pay off. Walravens comes down on the growth side of the equation:

Cloud computing consists of three segments: infrastructure as a service, platforms as a service and applications as a service. Our due diligence suggests that Rackspace has emerged as a clear number two to Amazon Web Services for infrastructure as a service and is well positioned in the platform as a service market.

Walravens' big point: Software is moving online and that means cloud providers will benefit. Indeed, Omniture, NetSuite, SuccessFactors and Salesforce.com are just some of the names in the new breed of software companies.

Meanwhile, enterprises are increasingly dabbling with the cloud in hybrid data center deployments. "We've had some nice wins," said Napier. Rackspace executives noted that the company saw improving enterprise traction in the second quarter with April being a record month. The big takeaway: Rackspace's business environment is better today than it was six months ago.

Here's a look at the key metrics for Rackspace: