Smartphones: Commoditization looms; shakeout can't be far behind

Smartphones used to carry a price premium. In reality, they're starting to look a lot more like feature phones and the only distinguishing characteristic may be price.

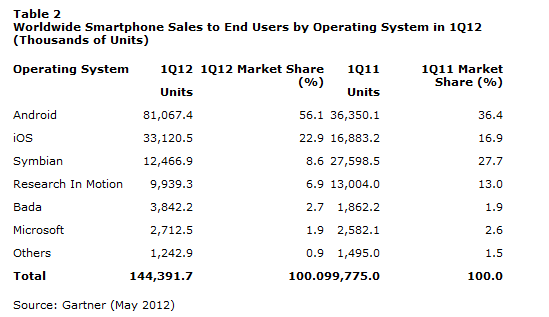

As folks sort through Gartner's mobile phone statistics, there's one quote that sticks with you.

The smartphone market has become highly commoditized and differentiation is becoming a challenge for manufacturers.

"This is particularly true for smartphones based on the Android OS, where a strong commoditization trend is at work and most players are finding it hard to break the mold,” said Gartner analyst Anshul Gupta. “At the high end, hardware features coupled with applications and services are helping differentiation, but this is restricted to major players with intellectual property assets. However, in the mid to low-end segment, price is increasingly becoming the sole differentiator. This will only worsen with the entry of new players and the dominance of Chinese manufacturers, leading to increased competition, low profitability and scattered market share."

IT buyers know what comes next. Supply gluts---Gartner is already noting that the smartphone channel is filling up quickly---price cuts and a market where hardware differentiation doesn't exist.

The good news is that Android shops will get almost-free handsets. ZTE and Huawei are likely to blow up pricing for Android incumbents. The reality is that smartphone buyers will gravitate to the one Android player with massive scale---Samsung.

In this new smartphone world order, Apple will rake in the most dough along with Samsung. Nokia and Microsoft may garner momentum since they have a unique smartphone play that has yet to catch on. RIM's future rests on BlackBerry 10 devices. And the Android hardware players will simply kill each other.

Bottom line: The smartphone race will look dramatically different a year from now. A shakeout is on the horizon.

Related: Gartner: Samsung steals Nokia's crown as global phone leader