Sprint's inferno: Churn baby churn

Sprint Nextel said Monday that it has lost more than 1 million customers in the last year.

Sprint, which has been busy of late with a WiMax joint venture with Clearwire and alleged takeover overtures from Deutsche Telekom, provided a healthy dose of its financial reality with its first quarter results.

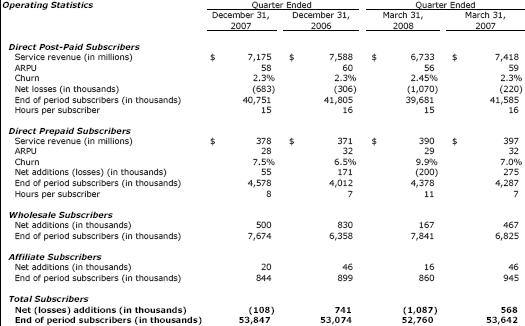

But the real issue is churn, which was 2.45 percent in the fourth quarter, up from 2.3 percent from a year ago. Meanwhile, average revenue per customer was $56, down from $59 a year ago.

Here's the overview (click for full version):

"The prepaid swing to a subscriber loss is troubling in its timing and magnitude, one quarter earlier than we thought and twice as large. ARPU was also very weak," said Soleil Securities Group analyst Gregory Lundberg in a research note.

Technically, Sprint's financials were better than expected--for whatever that's worth. The company reported an adjusted profit of 4 cents a share in the first quarter, compared to 18 cents a share a year ago. Wall Street was expecting a profit of 2 cents a share on an adjusted basis.

That's just about where the good news ends.

Sprint reported a first quarter net loss of $505 million, or 18 cents a share, on revenue of $9.33 billion, down 8 percent from a year ago. The biggest reason for the decline was the exodus of wireless customers. Sprint's total wireless subscribers fell 1.09 million in the quarter.

In a statement, Sprint CEO Dan Hesse said:

"As expected, our wireless business delivered weak financial results. While the business will continue to face challenges in the short term, we are making progress in methodically attacking the sources of our performance issues. In the first quarter, we implemented a new, more focused brand campaign, we executed on our plans to take costs out of the business, and we made progress on the larger organizational and strategic decisions that we believe will lead to improved profitability in the long term. We continue to place the highest priority on reducing churn by improving the customer experience."

The problem: Once you dig a customer service hole it takes years to get out.

As for churn, Sprint is guessing that the number of subscriber declines has peaked, but whether the company is right "will depend on how aggressive Sprint is on lowering prices," said Oppenheimer analyst Timothy Horan.

Despite Sprint's wireless problems, the company ended the quarter with 52.8 million total subscribers, which could get another wireless carrier such as Deutsche Telekom's T-Mobile bigger in a hurry.

For now, Sprint is signaling more pain ahead. It expects "continued downward pressure" across all of its key financial metrics, but expects them to stabilize by the end of 2008. On the churn front, Sprint said:

"In the second quarter of 2008, we expect to report an improved post-paid customer churn rate and net post-paid subscriber losses to improve marginally from the first quarter."