Sun posts $1.67 billion loss on write-off

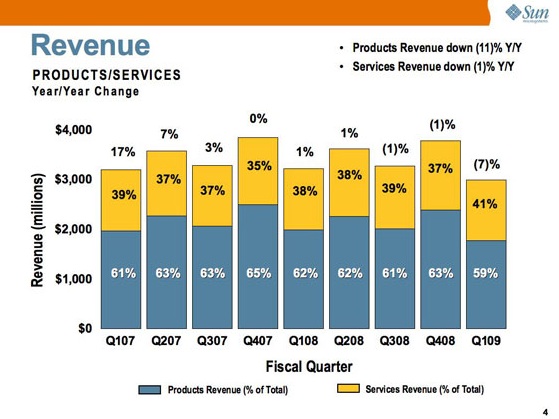

updated: Sun Microsystems reported a loss for the first quarter of its fiscal 2009 year of $1.67 billion, or $2.24 per share, on revenue for $2.99 billion, down from $3.22 billion for the first quarter of 2008 (statement). The loss was largely attributed to the write off of a $1.44 billion non-cash charge for goodwill impairment and $63 million in restructuring charges. Excluding charges, the loss per share was 9 cents, compared to earnings of 32 cents for the year-ago quarter.

Analysts had been expecting a loss of 8 cents a share excluding charges on sales of $3.14 billion. Total gross margin as a percent of revenues was 40.2 percent, down 8.3 percent from the first quarter of 2008. The company warned Wall Street earlier this month that it would miss its targets, attributing the performance to a combination of factors, including current economic conditions and a sustained decline it its market valuation.

"The economic downturn continued to weigh on our customers, especially those that contribute to our traditional high-end businesses." CEO Jonathan Schwartz said in a statement.

On a call with analysts, Schwartz noted that there had been a softness in demand in North America, Europe and Asia Pacific markets. Customers are feeling a consistent anxiety about economic conditions, he said, and are pushing off large-scale purchases. He also reminded analysts that he's noted in the past that Sun's traditional exposure to high-end enterprise systems has made it more vulnerable than peers with a more diverse portfolio. While the company is working to diversify its offerings, those initiatives don't change things overnight, he said.

"All in all, it was a tough quarter," Schwartz said.

CFO Mike Lehman added that the company is "not at all satisfied" with the financial performance of the quarter and said it is taking steps to restore the company to previous performance levels. He also noted that, given the economic environment, the company would not be offering guidance for, or answering questions about, its full year performance.

Shares of the company were up more than 9 percent in regular trading, closing at $5.29.

In its release, the company noted a few first-quarter highlights:

- Sun reported 83 percent year-over-year billings growth in its Solaris-based Chip Multi-Threading systems as customers continued to demand the nearly 10,000 applications available for Solaris 10, while enjoying integrated virtualization and exceptional power efficiency.

- Sun's Solaris-based Open Storage product line continued to see aggressive growth during the quarter as the adoption of ZFS - the most advanced file system available in the open source community – and open systems continue to be ever more critical for addressing customer pain points in today's challenging economic environment.

- Sun reported 12 percent year-over-year revenue growth in the Emerging Markets region, with India, Latin America and a combined Russia, Middle East and Africa geography growing double digits year-over-year.

- Sun announced a new version of Sun xVM VirtualBox as well as xVM VirtualBox Software Enterprise Subscription, offering 24/7 premium support for enterprise users. Sun xVM VirtualBox also surpassed 6.5 million downloads worldwide and 15,000 downloads per day.

- Sun partnered with Fujitsu on a new enhanced line of SPARC Enterprise servers that deliver a virtualization and consolidation platform with up to 80 percent better performance on commercial applications and 2x better performance on HPC workloads and using 44 percent less energy per core.