Sun's fourth quarter solid; Growth in fiscal 2009 remains elusive

Sun Microsystems on Friday reported fiscal fourth quarter net income of $88 million, or 11 cents a share, on revenue of $3.78 billion, down 1.4 percent from a year ago. Adjusted earnings in the quarter were $275 million, or 35 cents a share. However, Sun sees another tough year ahead.

The results topped Wall Street expectations calling for fourth quarter earnings of 25 cents a share on revenue of $3.72 billion (statement). Sun said July 15 that its results would top lowered expectations. Sun also announced a $1 billion stock buyback plan to bolster its shares.

But the outlook for 2009 looks dicey. CFO Michael Lehman said the slowdown in demand the company saw in its March and June quarters will spill over into the first. "We enter the fiscal year with a number of challenges," said Lehman on the company's earnings conference call. "The biggest variable will be the buying patterns of our large U.S. customers. We expect modest low single growth in revenue. The first quarter in particular will be challenging. "

Lehman added that first quarter revenue will decline from a year ago and the company doesn't expect to turn a profit on under generally accepted accounting principles. For fiscal 2009, Lehman said Sun doesn't expect U.S. growth until the second half of the year at the earliest. "Given the current environment we're focused on how to improve our results one year at a time," he said.

For fiscal 2008, Sun reported flat revenue of $13.88 billion with margins of 46.5 percent, an improvement of 1.3 percent from 2007. Net income for the fiscal year ending June 30 was $403 million, or 49 cents a share, down from $473 million, or 52 cents a share, in 2007. Excluding items, Sun reported net income of $1.1 billion, or $1.34 a share.

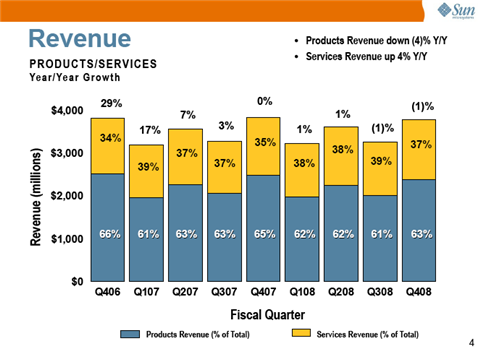

While the results are an improvement compared to estimates that have been lowered repeatedly in 2008 the bigger worry is about Sun's growth potential. It has been making its quarters via cost cutting and the revenue growth just isn't there. The chart tells the tale:

On a conference call, CEO Jonathan Schwartz indicated that the U.S. economy is hurting growth, but noted that Sun is improving its operating metrics. Schwartz maintained that the company's move to become an open source leader is the right approach. Sun also said MySQL billings in the fourth quarter were up more than 44 percent from a year ago.

Other notable points from the conference call:

- Schwartz said in 2008 international growth offset weakness in the U.S. He also noted that Sun is more dependent on U.S. sales than its peers. In other words, the U.S. will keep the lid on Sun's growth potential.

- MySQL is fastest growing database and has 12 million users.

- AMD's quad-core delays hurt Sun's server sales and Schwartz admitted that it didn't have a full Intel lineup. Product margins on high end servers fell.

- Schwartz said customers say that open source will be the "path forward" for them in data centers. Schwartz argued that technology buyers are consolidating budgets and moving toward open source.

- In 2009, Schwartz said the company will focus on emerging markets, acquiring new customers through partners and cultivate the open source community, aligning sales resources to growth areas and optimizing systems based on open source technologies.

Also see: JavaFX SDK preview launches: Can Sun play the RIA game?

Sun said it only had $36 million of the $3 billion share repurchase plan left from the buyback initiated a year ago. In comparison, Sun plans to spend $2 billion less on share repurchase than it did a year ago.Among the key slides:

Gross margin trends:

Server units:

And software trends (click to enlarge chart):