Tech financing: Are defaults becoming a worry?

The financiers of technology projects are seeing defaults rise and that ups the ante for customers looking for credit and the vendors extending loans.

The Wall Street Journal connects the dots.

- In September, 0.86 percent of equipment loans--that includes office gear--were written off. That's up from 0.48 percent. That's about the same rate as commercial real estate loans.

- Tech financing will hit $88 billion, or 14 percent of hardware and software spending. (Source: IDC).

- IBM, Oracle and Cisco are extending credit to customers to fill the void.

- Some of the financiers quoted in the story include Baytree Leasing Co., CIT, Capital Technology & Leasing and KeyCorp. These are the lenders pulling back on tech financing.

It remains to be seen how big of an issue these defaults become, but you're essentially going to see two different approaches from vendors. Some--like IBM and Cisco--will finance customers. Other companies like Microsoft and SAP will rely on third parties.

Will more vendors enter the financing fray? They may have to. If you rely on third parties and credit gets squeezed some IT projects just won't happen. You can see how the financing issue could become a big deal for SAP, which sells software that can take years to implement.

The solution may be for more vendors to offer credit just as the risks multiply.

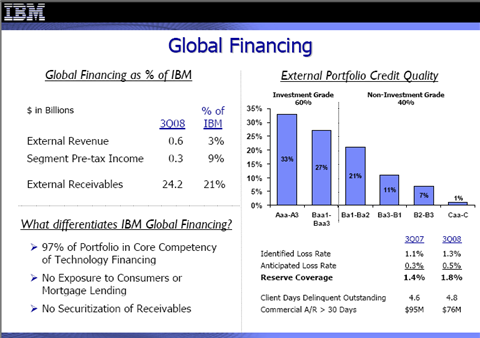

Some companies like IBM see the financing as an opportunity. IBM has a financing arm that is basically a bank. As expected IBM CFO Mark Loughridge talked a lot about Big Blue's financing arm about managing risks. I highlighted the "IBM as bank" worries ahead of the company's earnings, which were strong as preannounced.

When asked about IBM's financing arm and managing risk on the company's conference call, Loughridge said:

(The financing business) is much more driven by enterprise, whether it be support of the partner or the financing through that organization. We are very tough-minded on the credit evaluations and the certainty of repayment regardless of the product opportunity.

We have a very aggressive and disciplined program to price the risk, again regardless -- a narrow, a skillset that we apply very specifically to technology. We don’t go outside of those white lines and within financing, the strength that we have aside from the ability to assess the credit portfolio quite specifically, the real strength that we have is I think we have some of the best capability to evaluate the take-down curve on technology and evaluate that residual value. And as you all know, the residual value is a very powerful opportunity for us because -- and in the least, we bring that box back, we remanufacture it, we ship it out through either used equipment or equivalent to new and recoup a lot of the value. So it’s a much more operational manufacturing brand driven organization than strictly a financing opportunity.

Loughridge added that IBM's financing business is on "solid footing." In fact, much of IBM's call was focused on the company's ability to access the commercial paper market and the global financing unit. The message: IBM is part bank, but it knows what it's doing and has a narrow mission. Loughridge added that IBM's financing unit doesn't "get outside those white lines."

However, there are a few small signs of stress. IBM upped its reserve coverage 40 basis points in the third quarter from a year ago. The rate of identifiable losses increased from 1.1 percent to 1.3 percent and the rate of anticipated losses increased from 0.3 percent to 0.5 percent.

Loughridge also highlighted how IBM's approach to financing is different.

We closely monitor the credit of our clients and adjust as needed. It’s important to remember that the majority of the assets we’re talking about are in support of critical IT operations and have substantial value. Our leases are non-cancelable and we are financially protected in the event of a merger or acquisition. The assets we finance are critical to major financial institutions. In the event of bankruptcy, leases are often reaffirmed by the bankruptcy courts sustaining our expected lease payments. If necessary, the financed assets can be recovered and resold through our highly refined marketing operations, which extract significant value in the event we have to repossess the equipment. So we have the ability to manage our risks.

While IBM may be able to manage risks other vendors may not have the experience assessing credit risks. Watch this issue closely because it's going to impact technology spending--as a help or hindrance--in the future.Also see: