Traditional software licensing: Why you pay more and a look at your options

It's hard to believe that some of the most profitable software companies in the world--Oracle, Microsoft and SAP--are sitting on a licensing model that is untenable in the long run and will increasingly irk customers. But there may be a revolution in the cards that could tip the balance of power, argues Gartner.

In a presentation, Gartner analyst William Snyder makes the case that software profit margins will erode. These software giants will fall to the same pricing pressures their hardware cousins. Snyder spoke at the at the Gartner Emerging Technologies Conference this week.

See more from Gartner:

- Gartner: Windows collapsing under its own weight; Radical change needed

- Video: Cisco’s virtual health care project

- Video: Sun Labs looks into ‘proximity communications’

- MGM Grand’s IT green field: RFID meets alcohol; predictive modeling; bandwidth galore

- Gartner: $100 laptop still too expensive for the emerging markets

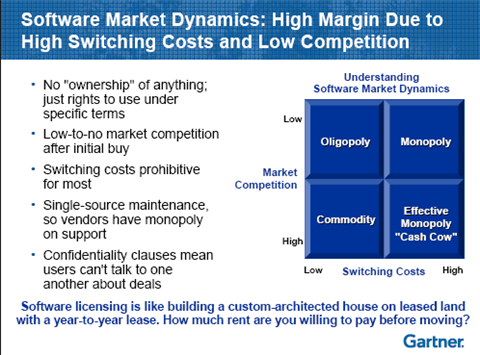

Let's face it: The hardware market is commoditized, workers are being offshored and budgets are being cut. Yet you're paying more in support and maintenance of software. Snyder says something doesn't add up here. I'm inclined to agree, but there's a reason software pricing sticks: It's an oligopoly market dominated by just a few vendors--SAP, Oracle and Microsoft. And these software giants are just getting bigger via acquisition. These giants have the largest installed bases and feature applications that are difficult to uproot. Snyder argues that open source may change the equation. I reckon a little customer revolt wouldn't hurt either. Snyder hints at a budding revolution:

Software budgets remain one of the last stubborn areas of budget resistance. In other areas, such as hardware and networking, competition, standards and free market economics have improved costs during the past two decades. Even the human staffing line item has seen lower costs by moving selected work offshore. Through it all, software maintains high prices due to high switching costs and the method of commerce known as software licensing. Due to continuous pressure by enterprises, IT organizations will continue to look for ways to reduce software costs in whatever legal ways it can.

The problem: Software buyers are dealing with massive vendors where transparency isn't exactly the norm.

Ultimately, this situation is untenable. Snyder makes a good point: He says that loyal software customers are treated worse than new customers unlike other industry. There are no points for loyalty in the software business.

Snyder notes:

CIOs are struggling with the fact that so much of their budgets are consumed by maintenance and support commitments for utilities, and they are looking for ways to cut that back, to free up funds to innovate the business, as required by their CEOs. IT organizations face pressure to reduce costs permanently. This has often been achieved in hardware and services, but not in software - the only IT market that sustains 75% to 80% gross margins, and 25% to 35% net margins. When many companies struggle to make 25% to 30% gross margins in their core businesses, it becomes increasingly difficult for software procurement specialists to claim to be doing an excellent job.

The problem with this "software licensing is cooked" argument is that it's brain surgery to swap applications. Sure you could switch to SaaS, but that takes a lot of upper management buy-in if you're doing more than CRM. Today it's unclear how much negotiating power customers really have. You can play Oracle and SAP off of each other, but that may not get you too far after the pain of another implementation.

Snyder says there's hope. Here's a look at some of his key points:

Business process outsourcing will erode software licensing margins. Snyder says that business process outsourcing is the fastest growing market in IT. Why buy another HR app when you can outsource it? As these BPO options grow software vendors could find themselves in a bind. Another interesting thread: These BPO firms don't play the lock-in game with software vendors--after all it hurts the BPO margins. According to Snyder's presentation:

Several BPO companies have custom-developed software offerings that automate the processes they bring to market in their products. They do not use commonly available commercial applications from the major software vendors because, in many cases, they do not want to depend on a provider with such high margins, where lock-in is so extreme. This reduces the market opportunity for software vendors.

The takeaway: Use BPO firms as leverage when negotiating with software vendors.

Modular software architecture (SOA) could be a threat. Snyder argues that SOA can be a threat to traditional software vendors--especially if you use offshore resources to build the Web services. Another perk: Implementing a software module is a lot easier than a giant ERP system.

The takeaway: Use offshore firms and the threat of Web services in negotiations with software vendors.

SaaS vendors will ding licensing margins. The SaaS model is already changing the vendor-buyer relationship argues Snyder. With SaaS switching costs are lower and so are the upfront fees. Snyder notes that large software vendors that are tackling SaaS don't understand the profit margin dynamics in that sector.

The takeaway: SaaS vendors are negotiating leverage with your current software provider and may be a good replacement. However, there's a significant SaaS caveat. Snyder argues that SaaS providers will increasingly look like they are using a traditional software licensing scheme and if you don't pay attention your costs over five years could be as much as 30 percent or more higher than you expected. SaaS costs have been an ongoing theme on the Enterprise Irregular mailing list. Snyder writes:

Many SaaS providers offer great initial deals on hosted software. However, buyers face problems with locked-in, uncapped price hikes on renewal and hidden costs for increased use. When evaluating SaaS deals, don't be deceived by low per-user, per-month fees. Instead, explore the financial implications of issues such as setup costs, hidden license metrics and termination fees. Where feasible, obtain comparative estimates for an on premise implementation, or for an arrangement in which your company purchases the hardware and software licenses, and then contracts with an external outsourcing organization for management.

The open source movement will erode software licensing margins. To me, this open source argument is Snyder's most plausible--once the applications are comparable. Sure there are implementation and support costs with open source, but the bottom line is quality low-cost applications are increasingly coming down the pike.

Snyder cooked up the following prospecting chart:

As you can see each type of application is different as a viable threat to traditional software vendors. For instance, JBoss' maturity would give you more leverage against your incumbent middleware provider. That chart, however, is likely to be fluid as open source moves up the software stack.

Takeaway: Open source is an option at best and negotiating leverage at worse. Snyder reckons that incumbent software giants will have to innovate at a rapid clip to show their worth.

Emerging markets will cut licensing software margins. Snyder argues that the current licensing structure just won't fly in emerging markets. That fact means that incumbent software vendors will either have to cut prices or watch these IT green field markets move toward open source and SaaS. And without legacy software to support customers in China and India can experiment with any of the aforementioned models mentioned above. In either case, software licensing margins are in danger.

The big question: What's the timing on this margin pressure? The answer will be determined by the economy and the desire of CEOs to undercut relationships with their existing software vendors. But additional cost savings can tip that balance pretty quickly.