Xerox buys ACS; Makes its big services bet

Updated: Xerox said Monday it will buy Affiliated Computer Services in a cash and stock deal valued at $6.4 billion. The move is a big bet to transform Xerox into a services company that does everything from collecting tolls and installing government systems to retooling business processes and information technology outsourcing.

Xerox is valuing ACS at $63.11 a share, up from ACS' closing price of $47.50. The transforms Xerox into a services company that can focus on business process management and outsourcing (statement, Techmeme).

The company, which is in a dogfight with HP for print managed services, is apparently looking for more foot soldiers to cross sell everything from process overhauls to document management programs. After all, HP can use its EDS army to sell print managed services in addition to other items. ACS had $1 billion in recurring revenue during fiscal 2009.

For Ursula Burns, Xerox CEO, the ACS deal is a defining moment that comes early in her tenure. In a statement, she said:

By combining Xerox’s strengths in document technology with ACS’s expertise in managing and automating work processes, we’re creating a new class of solution provider.

Indeed, Xerox will have a $22 billion company with $17 billion in recurring revenue. When you combine the Xerox deal with Dell's purchase of Perot Systems last week you arrive at an easy conclusion: Everyone wants to be a services company.

For ACS, the Xerox deal is another trip to the altar. Cerberus Capital Management announced a plan to pay $6.2 billion for ACS two year ago, but the private equity firm later pulled its offer.

J.P. Morgan analyst Tien-tsin Huang recaps the ACS recent history:

In November 2005, ACS received a proposal from a private equity firm to be acquired for $62/share according to a SC TO-I filed by ACS on Feb 9, 2006, but talks broke down because ACS would not proceed for less than $65/share and talks eventually ended in January 2006. Later, on Feb 9, 2006, ACS took a different path and announced a Dutch auction tender offer of up to 55.5m shares at a range of $56-$63, which was undersubscribed with 7.36m shares tendered at $63 or 6% of Class A shares in March 2006. In June 2006, ACS announced $1B repurchase program. In March 2007, Cerberus and offered $59.25 to acquire ACS, which was later raised to $62, and eventually withdrawn on October 2007.

Chances are that ACS shareholders will happily take the Xerox deal. ACS shareholders get $18.60 in cash and 4.935 Xerox shares for each share they own. Xerox picks up ACS' $2 billion debt. As for the synergies, Xerox said the deal is about growth:

Xerox is confident it will achieve significant incremental revenue growth by leveraging Xerox’s strong global brand and established client relationships to scale ACS’s business in Europe, Asia and South America. In addition, Xerox will integrate its intellectual property with ACS’s services to create new solutions for end-to-end support of customers’ work processes.

However, there will be some savings. Xerox said it will save $300 million to $400 million annually in the first three years once the deal closes. The savings are related to back office, procurement and the costs related to running a public company.

A few things to note about the companies:

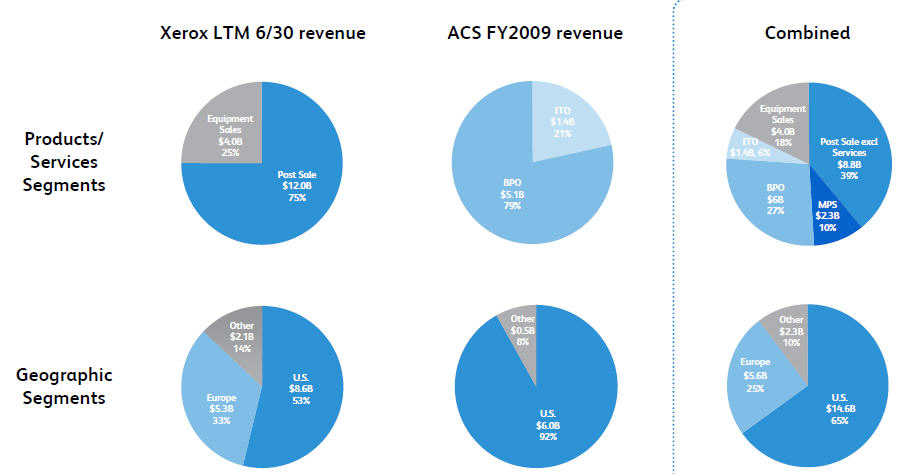

- Xerox and ACS have 20 percent customer overlap to leave multiple cross selling opportunities. Here's the combined revenue pie.

- Executives said the lines between business process and document management are blurring.

- Here's how the synergies break down:

- ACS taps into multiple commercial and government accounts.