Yahoo lowers its outlook for 2008; Sees 'headwinds'; Restructuring in Feb.

Yahoo's fourth quarter results Tuesday were better than expected, but the company's outlook for 2008 disappointed. Meanwhile, Yahoo didn't deliver layoffs as many prognosticators were expecting, but CEO Jerry Yang said a workforce review and a targeted "jobs realignment" will begin in February.

First the good news (relative to expectations): Yahoo's fourth quarter net income was $206 million, or 15 cents a share, on revenue (minus traffic acquisition costs) of $1.4 billion. Excluding charges, Yahoo's earnings were 20 cents a share. According to Thomson Financial, Yahoo was expected to report earnings of 11 cents a share on revenue of $1.4 billion for the December quarter.

However, Yahoo's outlook wasn't up to Wall Street's expectations, but that guidance shouldn't have shocked anyone. On a conference call with analyst Yahoo CEO Jerry Yang said the company has a restructuring on deck. Instead of across the board cuts, Yahoo will make targeted cuts and redeploy talent. Yang added that Yahoo will also invest heavily in growing strong performing properties. Yang said the company was making fundamental changes to the business and not merely "tinkering around the edges."

Yahoo CFO Blake Jorgensen said that the restructuring will impact about 1,000 jobs, almost 7 percent of the company's estimated 14,500 employees. The company will take a charge of $25 million in the current quarter.

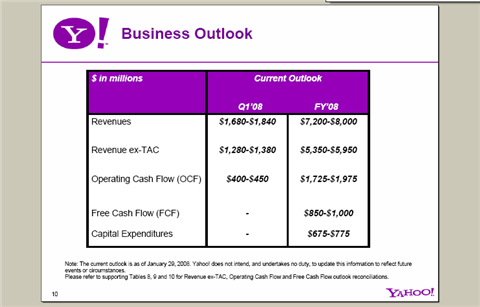

All of those moving parts--along with economic worries--means that Yahoo's outlook is light. Here's the money slide:

For the first quarter, Yahoo was also expected to report earnings of 11 cents a share on revenue of $1.37 billion. That revenue target is now a reach.

Earnings for 2008 were expected to be 52 cents a share on earnings of $5.89 billion, according to Thomson Financial.

To say these results (statement) were highly anticipated would be an understatement. First there were reports about a fourth quarter debacle, then layoffs and then guesses that maybe the quarter wasn't so bad after all. It was enough to make your head spin. There may also be some disappointment that Yahoo didn't announce a dramatic downsizing today as some folks were advocating.

Separately, Yahoo named Aristotle Balogh, 43, chief technology officer. Balogh was the CTO for VeriSign. He will oversee Yahoo's engineering team and manage technology operations and report to Yang.

In addition, Yahoo expanded its alliance with AT&T. The agreement is an ad revenue sharing deal that spans handsets and PC desktops. Yahoo will power a new portal for AT&T and provide search and display advertising for AT&T customers on mobile devices and PCs. The deal covers AT&T properties including U-verse TV, Yellowpages.com and other sites.

However, the outlook for Yahoo overshadowed those developments.

In a statement, Yang said:

"While we will continue to face headwinds this year, we believe that the moves we are making will help us exit 2008 stronger and more competitive and return to higher levels of operating cash flow growth in 2009.”

On a conference call with analysts, Yang said the underlying trends in search and display advertising are showing improvement. "Our efforts to build a premier display ad network and search are paying off," said Yang. He emphasized the company's previous plan to focus on the home page and other core properties and touted Yahoo's Life initiatives.

Other key figures on the state of Yahoo:

- Fourth quarter operating income in the fourth quarter was $191 million, down 38 percent from a year ago.

- U.S. fourth quarter revenue was up 15 percent from a year ago with international revenue falling 7 percent.

- For 2007, Yahoo reported revenue of $5.13 billion (excluding TAC), up 12 percent from a year ago. Net income for the year was $660 million, or 47 cents a share, down from earnings of $751 million, or 52 cents a share in 2006.

On the conference call there were a few key takeaways that are worth noting. To wit:

- Yahoo president Sue Decker said Yahoo is pruning properties and optimizing resources. The company is trying to shutter non-performing properties.

- Decker kicks Comscore. Decker noted that Yahoo's page growth was growing at a double digit clip in contrast to what Comscore is reporting. Welcome to the club Sue. Decker noted that the company is using visits instead of page views and unique users as a more appropriate metric for Yahoo's key properties.

- Yahoo is investing heavily in open source grid computing. Decker cited a "major investment in open source grid computing." This infrastructure is already improving algorithmic search and advertising, said Decker. In the future, Yahoo will building new systems and services on this grid computing infrastructure.

- Yang was pressed about display advertising and the possible impact about a weak economy. Yang said Yahoo wasn't making predictions--a good move considering how often economists are wrong.

- Why would Yahoo's investment pay off? Yang said U.S. display growth grew 20 percent year over year and noted that Yahoo's core business is healthy. If that state of affairs holds, Yahoo should be able to gain from its investments in its display ad network. "We do believe that the investments we are making now in display advertising will be a differentating point in the future," said Yang.

- Decker said Yahoo plans to integrate a "social graph" into its key properties. The big question is whether Yahoo can monetize this inventory.