Agresso's answer to ERP addiction

Earlier today I took a briefing from Agresso. Up front I'll say that I have something of a soft spot for this company. Some years back I did some very early formative work on what is now their BLINC (Businesses Living In Change) schtik and was one of the first people to put Agresso through its paces in a testing lab situation back in the mid-90's.

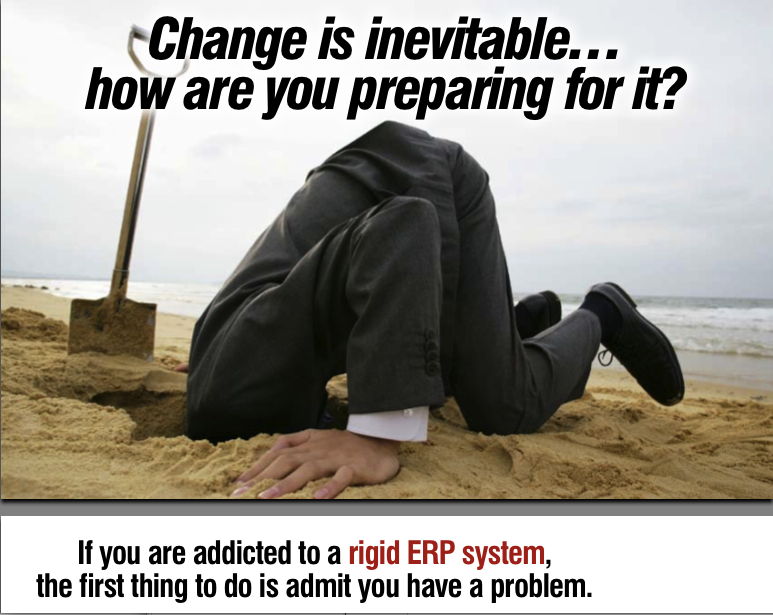

The purpose of the briefing was to discuss the idea that ERPs which are inflexible could be costing business time and money set against the backdrop of an addiction to existing solutions. This is clearly a swipe at SAP/Oracle and the subtext is 'come to us' but that's OK. All vendorsd make what they hope are differentiating claims and all should be tested against reality.

Last year, Agresso hired IDC to review how mid-range organizations manage the software selection process and the post implementation results of those selections. The results showed:

Business software buyers tend to favour, and simply re-select, their current ERP vendors, despite facing steep costs after implementing their software. This was one of the key findings of a survey sponsored by ERP vendor Agresso, and conducted by IDC, as part of its quarterly AppStats Survey in March 2008. A stunning 83% of mid-sized companies said they will still buy from the same ERP vendor, regardless of suffering from inflexibility when the need to make changes arises. Not only does this persistence resemble a true addiction, so do the symptoms of this ‘irrational’ behaviour: users are faced with hidden costs and tend to make the wrong decisions based on a lack of information, to name a few.

There is no logic to this thinking and in that sense Agresso is right to describe it as an addiction. CFO's are particularly difficult to persuade, wedded as they are to a firmly held belief that Excel is the heart of their business information needs. That despite years of evidence suggesting that spreadhseets are downright dangerous when in the wrong hands. But then many of my colleagues contend that ERP buying decisions rarely seem based on rational assessments, something with which I concur.

As the ERP market coalesces around the twin gorillas of SAP and Oracle, the myth has emerged that organizations cannot switch. The logical conclusion is that customers are held ransom to the whims of these suppliers. I don't believe that although I can see that for some global companies it would be a devil's own job to yank out hundreds of millions of dollars in IT investment. At a time when the market may be on the brink of a sudden reverse (check what's happening with IBM,) risk aversion adds to the sense that making the kind of change Agresso is punting is way too dangerous.

However, when I interviewed a number of its customers, they all reported a sense of deriving continued value that stands in marked contrast to the ongoing kerfuffle SAP is experiencing as it attempts to impose a 30% increase in maintenance and support fees. More to the point, Agresso seems more focused on delivering value than keeping 'The Street' onside as recently demonstrated by Safra Catz, Oracle's co-president:

“We get to keep virtually all of that money,” said Oracle Co-President Safra Catz. Sure, some of that goes to customer service, but Catz said that mostly customers are paying for access to the new software – and Oracle is going to develop that new software regardless of whether customers pay them maintenance fees. For Oracle, maintenance is pretty much free money, about $10.5 billion worth in its 2008 fiscal and about $1.5 billion more than that this year. “When many customers just send you money for something you’re doing anyway, you literally can’t help [but increase profits],” said Catz.

Such cynicism doesn't go un-noticed but what does it take to get companies thinking differently? The answer is in pre-selecting those companies most likely to experience change as a fact of life. You might think that's just about everyone but that's not true.

Many companies in manufacturing industries prefer to get somewhere close to 'steady state' while those in service industries are much more volatile. It is those service industries and specifically those that are project oriented where Agresso claims it performs best. Even then, the value proposition of a lesser known solution like Agresso is not easy to communicate in a market where the noise is coming from the top via advertising and marketing budgets running billions of dollars. Agresso responds by pointing out that 70% of customers it surveyed believe they can implement 80% of post-implementation changes required without the need to bring in outside consultants. That begs the question about the remaining 20% and the likelihood that this represents a potentially significant cost burden. But to achieve those levels of change in the manner described is a solid benchmark with significant cost/benefit implications.

How does this translate into performance? Ray Wang at Forrester rates Agresso very highly on the company's licensing model. If Ray's impressed, you should take notice. He's a very smart person who's been around this industry a very long time. Aggresso's first half 2008 results were solid, with year on year revenue up 25% compared to 2007 and a sensible if not market leading 16% EBITDA. In the Americas, Agresso is a small player with only five percent of total revenue coming from this source. Even so, growth of 74% in H1 2008 in this market is not to be sniffed at.

One area of potential weakness is talent management. New competitors like Taleo, Zapoint and SuccessFactors are picking up market share at a time when the human capital management market is showing signs of becoming truly interesting as organizations find fresh ways to discover talent. The new competitors are saas players where Agresso offers web based deployment. That's not the same thing. Agresso responds by saying it has acquired in this area but it has yet to hit the headlines as a player. On the other hand, its CODA acquisition and that company's subsequent alignment to Salesforce.com's Force platform makes for a vendor with an interesting blend of relatively mature and emergent offerings for its chosen verticals.

As the company continues to make progress, I'll be looking for current customer examples that make the case for the company.

1st image courtesy of Agresso, 2nd image from IDC.