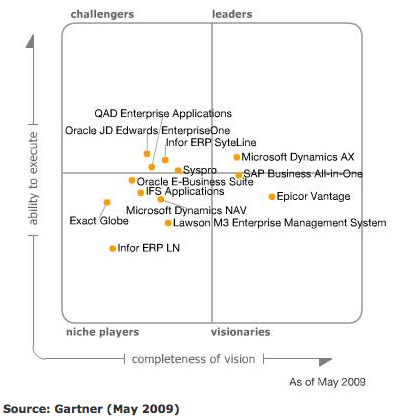

Gartner's conservative mid-tier ERP Magic Quadrant

'Tis the season for round robins. On this occasion Frank Scavo pokes a sharp stick in the eye of Gartner's Mid-tier ERP Magic Quadrant.

Vinnie Mirchandani goes next having a poke at his alma mater...Guess what? It's my turn:

First up let me say that in my opinion the quality of much analyst tech coverage is many levels below what it was in the 1995-2000 period. Yes, I know, that's when Vinnie was there but he was one among a clutch of titans who were fiercely independent and openly critical of vendor shortcomings. They were always in demand as interviewees. Today? The analyst community is more obsessed with sales and tin-cupping the vendors than worrying about report quality. Sorry guys and yes, I know a LOT of analysts at Gartner, AMR and Forrester who are good people but they end up playing second fiddle to the sales people. I also know a lot of super smart, fearless independent analysts. They are far more agile and incisive than Gartner et all and are growing in stature as the 'people to read.'

In my opinion, they ARE the future of buy side analysis. The vendors may find them inconvenient but isn't that always the way when you move away from the vendor marketing? Or as one ex-analyst told me this week in regard to Oracle: "They don't like to see people messing with the message." I'll bet they don't. Back to Gartner's MQ. My 2 cents worth:

- Gartner talked loosely about the saas vendors, even mentioning a few. But no concrete reason was given for exclusion. Why? It doesn't make sense given the fact Netsuite for example is a $100 million business vying for business in a number of manufacturing categories.

- Vinnie mentions Axapta AX in Europe. He is right though I would have liked to see some understanding of how Navision fits into this landscape. The reality is that Microsoft's acquired products: Solomon, Navision, Great Plains and Damgaard don't travel well. When they do, they travel inconsistently.

- JD Edwards a niche challenger? After all these years? What does that say about Oracle's investment in this company?

- Gartner says: "Challengers have broad and mature ERP systems" - it's the mature bit that gets me. SaaS players are constantly innovating. You can argue...and yes from an immature base offering. But I am finding that 'good enough' even if it is lacking, is often acceptable as the trade off for costly implementations that may deliver dubious value. I am surprised Gartner did not seem to pick up on this but then they are bound by a certain methodology. For Visionaries, it says: Visionaries might have compelling product strategies, but they lack the market momentum or have limited market presence to move higher in their ability to execute." The speed and pace of innovation is such that there is a blurring of the lines between visionaries and challengers. Again, Gartner methodology has not 'grown up' to reflect the new market reality.

- The inclusion of SAP Business All In One is an odd choice. This was in the crapper a few years ago and while there have been significant improvements, I would hardly say it has reached the point of nudging the coveted top right section of Gartners MQ. After all, it is almost an after thought at SAP customer conferences. And it's eye wateringly expensive.

It's certainly worth mentioning Frank's:

As a buyer, is "completeness of vision" really one of the two primary criteria in evaluation? How about fit to my functional requirements and industry? On this note alone, IFS and Lawson, with their industry-specific focus are being shortchanged in this version of the MQ.

Frank's comment fits well with my thinking about the saas players. 'Fit for business' is one of their key advantages, even when they market under a more generic banner. This section of the industry has understood vertical market value far more quickly than the incumbents.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=9baa08a2-a6aa-4dd0-9a41-7f9509555f68)