Wachovia: $211 trillion "word-processing error"

Here's a real oddball one for you. Wachovia Bank sent a letter to one customer complaining he was overdrawn on his account. According to WSBT television in Atlanta:

A Cobb County man got a letter from his bank with that very shocking news.

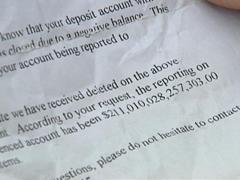

“And I open up the letter and I look at it and I’m like, ‘No, you’ve got to be kidding me,’ said Joe Martins.Martins said he recently closed an account at Wachovia Bank and made good on an outstanding check. He just got a letter about the closure and his negative balance -- $211,010,028,257,303.00. That’s $211 trillion.

Wachovia blamed the letter on a word processing error and the office of the president is sending a letter of apology.

Word-processing error? That implies the letter was manually typed by a bank employee, which seems unlikely, since a real person would have noticed the nonsense number. More likely, there was a back-end system bug, and bank doesn't want to disclose it.