Cognizant delivers strong Q2, raises outlook for 2013

Outsourcing company Cognizant reported strong second quarter results and raised its outlook for the year.

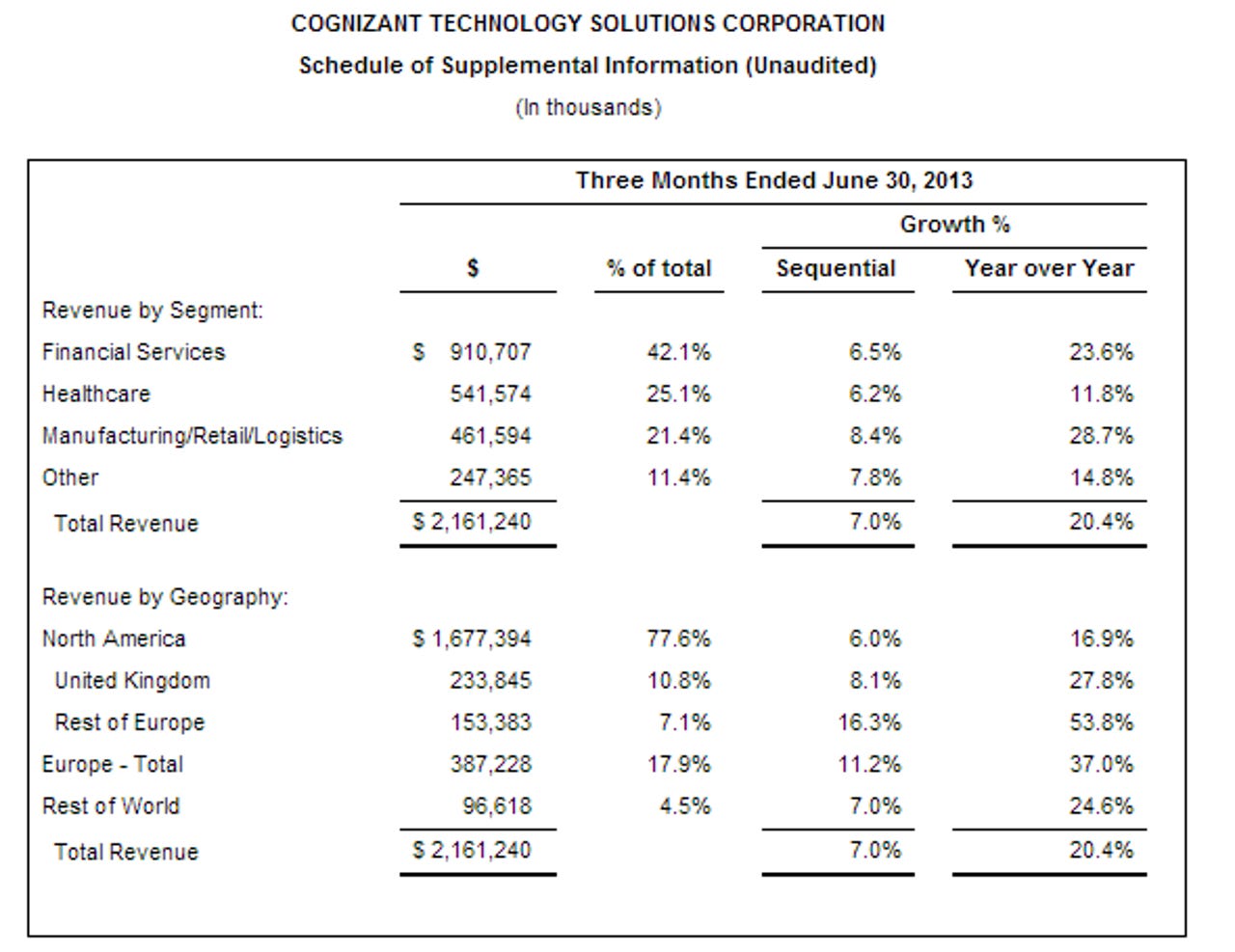

Cognizant reported second quarter earnings of $300.4 million, or 99 cents a share, on revenue of $3.16 billion, up 20.4 percent from a year ago. Non-GAAP earnings were $1.07 a share.

Wall Street was looking for second quarter earnings of 97 cents a share on revenue of $2.13 billion.

As for the outlook, Cognizant raised its view for 2013 and the third quarter. The company projected third quarter revenue of $2.25 billion with earnings of $1 a share. Non-GAAP earnings in the third quarter will be $1.09 a share.

For 2013, Cognizant projected earnings of $3.96 a share, or $4.32 a share non-GAAP on revenue of at least $8.74 billion. That outlook was also better than expected. Wall Street was looking for non-GAAP earnings of $4.02 a share on revenue of $8.64 billion.

On a conference call with analysts, Cognizant CEO Francisco D'Souza said the company has balanced investing in growth areas such as social, mobile and cloud computing while maintaining its core businesses such as business process outsourcing. He added that companies have to run better and differently than before.

D'Souza said:

As we look to the remainder of the year, we see a continuation of the healthy demand environment for our services, which gives us the confidence to raise guidance for the full year. The demand comes from us from a combination of macro trends and our own competitive positioning. On the macro front, in North America, our largest geographic market, has consumer and business confidence continued to show modest improvements, our clients are starting to turn their attention to making investments in software and services. Often these investments are funded through modest budget increases but more often the funding comes from driving efficiencies in other parts of the business. And in Europe, which represents the majority of the remainder of our business, as the macro environment in many countries continues to be challenging, we are finding an increased appetite from clients to move more work to a global delivery model.