EU to investigate Apple's Irish tax arrangements

The European Commission is launching an investigation into Apple's tax arrangements in Ireland, one of the continent's 28 member states.

The news, which first broke on Irish state broadcaster RTE, without naming its source, and was subsequently filed by the Reuters news agency, follows up from allegations that the iPhone and iPad maker used loopholes in international tax laws to reduce its overall payments to governments.

Apple previously said it complies with the law.

The EU's Competition Commission said in 2013 that it was looking into corporate tax arrangements in a number of member states, and had formally asked the Irish government for information.

According to Reuters, EU spokesperson Antoine Colombani declined to comment.

While this reportedly came as news to Ireland's finance ministry, which told the wire service it had not been informed of any such probe, it's not a surprise to U.S. senators, who stated last year that Apple had slashed billions of its U.S. tax bill by declaring its Ireland-based entities as not tax residents.

Sen. Carl Levin (D-MI), the chair of the U.S. Senate Permanent Subcommittee on Investigations chair, said Apple was "exploiting" a tax loophole in U.S. tax code, claiming that the company had "sought the holy grail of tax avoidance."

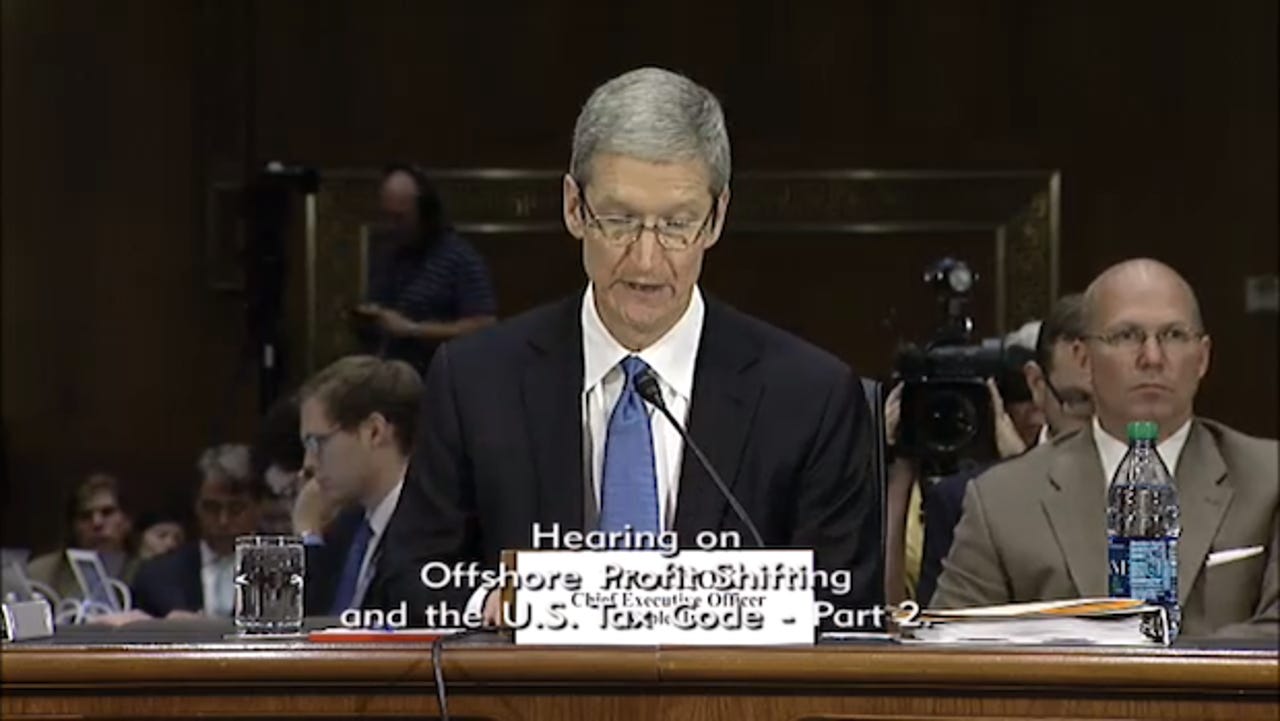

Apple chief executive Tim Cook was forced to defend himself and the company at the committee in May 2013.

Cook also said that 61 percent of all Apple's revenue was earned outside the U.S., and that Apple paid around $6 billion paid in taxes to the U.S. Treasury in the 2012 fiscal year — or about $16 million per day. The company claimed this accounts for $1 in every $40 in corporate tax the U.S. collected in 2012.

However, despite the back-and-forth in the committee, the U.S. Securities and Exchange Commission later cleared Apple's tax strategy, and that it would not be taking action at the time.

The company has also been accused of hiding more than $1.3 billion from the European taxman in Italy.