CIT unraveling could be headache for Dell, Avaya, resellers

The U.S. government has drawn a line in the sand---it won't bail out debt-ridden CIT, a financial services firm that loans money to small and midsized business in part to buy and lease technology equipment. Unlike other financial company implosions CIT's potential demise could have a direct impact on technology spending.

From CIT's annual report:

We have numerous vendor relationships and operations serving customers around the globe. We have significant vendor programs in information technology, telecommunications equipment, healthcare and other diversified asset types across multiple industries. Through our global relationships with industry-leading equipment vendors, including manufacturers, dealers, and distributors, we deliver customized financing solutions to primarily commercial customers of our vendor partners....

Vendor Finance includes a small and mid-ticket commercial business, which focuses on leasing office equipment, computers and other technology products primarily in the United States and Canada. We originate products through relationships with manufacturers, dealers, distributors and other intermediaries as well as through direct calling.

For the year ending Dec. 31, CIT's vendor finance unit had $12.2 billion in finance and leasing assets.

Now let's put some names on those in the tech sector likely to feel at least a few ripples form CIT's possible demise:

Resellers. CIT has a bevy of relationships with value added resellers and offers leasing arrangements for them. These VARs are also the small and mid-sized businesses that deploy a lot of technology.

Dell. Dell on its analyst meeting said it may have to look for alternative funding sources for its financial services unit. Why? CIT is Dell's partner. Dell has $35 million in accounts receivable from CIT, according to Dell CFO Brian Gladden.

Avaya. CIT's web site features Avaya as a case study. Here's a snippet:

Working with Avaya Financial Services (AFS), a unit of CIT, Avaya developed innovative financing programs to help enterprises with tight budgets gain the immediate and future benefits of an improved communications network in a tough economy.

Called “Zero Barriers,” the program offers zero-interest or low-interest financing to Avaya customers. Under the promotional program customers could lease the Avaya equipment they needed to improve efficiency, productivity and customer service with a small initial outlay and low monthly fixed payments. Leasing equipment also conserves capital, reduces the risks of ownership, provides tax benefits in some cases, and offers a wide range of other benefits to lessors.

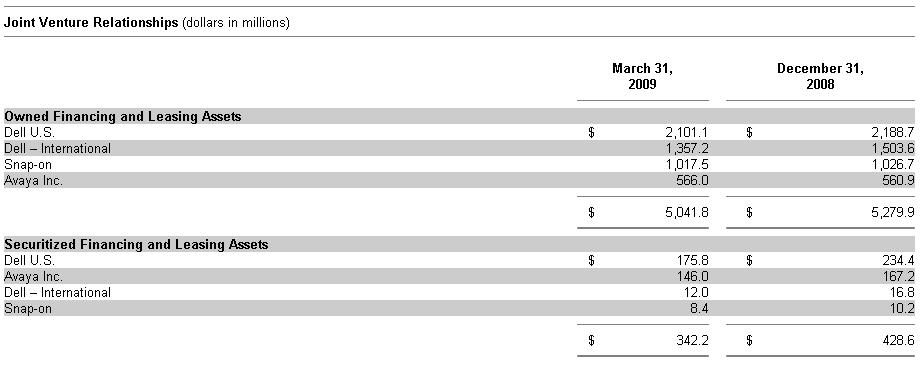

In fact, Dell and Avaya were listed as CIT's biggest joint ventures in regulatory filings.

The first quarter update on the Dell partnership went like this:

Until December 31, 2007, CIT was a partner with Dell Inc. (“Dell”) in Dell Financial Services L.P. (“DFS”), a joint venture that offered financing to Dell’s customers. The joint venture provided Dell with financing and leasing capabilities that were complementary to its product offerings and provided CIT with a source of new financings. In December 2007, Dell exercised its right to buy CIT’s interest and the Company sold its 30% ownership interest in the DFS joint venture. CIT has the right to purchase a minimum percentage of DFS finance receivables on a declining scale through January 2010. CIT has certain recourse to DFS on defaulted contracts. Financing and leasing assets related to the DFS program included in the CIT Consolidated Balance Sheet (but excluding certain related international receivables originated directly by CIT) were approximately $2.1 billion at March 31, 2009 and $2.2 billion at December 31, 2008. Securitized assets included in managed assets were approximately $0.2 billion at both March 31, 2009 and December 31, 2008.

And those are just the largest CIT deals. Dell and Avaya won't have a problem finding new funding partners, but there are a bevy of smaller deals that go bust we'll never hear about. Will a reseller be able to find a financing partner easily in a tight credit market? It's unclear how orderly CIT's potential unraveling will be, but given that the credit crunch was a big reason for the decline of corporate information technology spending it's a distraction the industry doesn't need right now.