Google first quarter earnings on deck: What to watch

Google's first quarter is expected to be roughly in line with expectations and some analysts say Wall Street may be too pessimistic about the search giant's financial results.

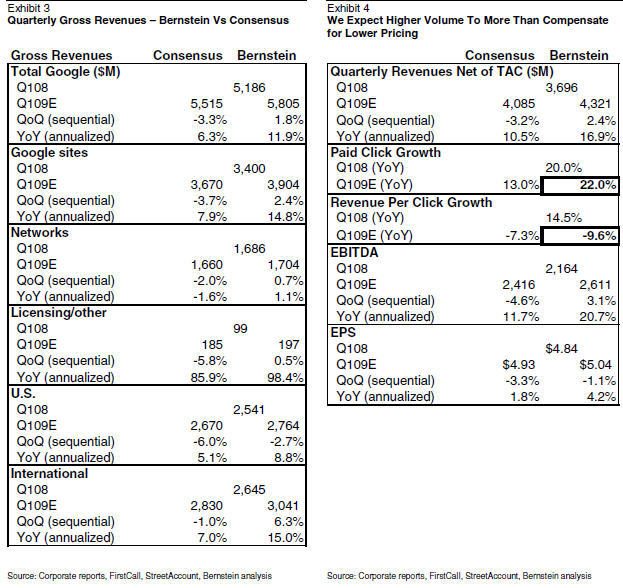

Google reports earnings on Thursday and as usual will be closely watched. Wall Street is expecting Google to report earnings of $4.93 a share on revenue of $4.08 billion.

Bernstein analyst Jeffrey Lindsay said in a research note that Wall Street has overblown concerns about Google. Of course, Google will be impacted by the economy, but it's also most likely to benefit from an upturn, argues Lindsay. Apparently, concerns about Google were stoked by a small number of layoffs at the company. Lindsay said:

Although Google is feeling the downturn like everyone else, we think the business is still highly recession-resistant and is doing better than many expect.

Piper Jaffray analyst Gene Munster agrees that Google is a "relative winner in the current economy." "The bottom line is that the consumer trend in increasing usage of search will be a continuous theme as consumers spend more time connected both through PCs and mobile devices, all of which benefits Google long and short term," said Munster in a research note.

That said there are a few worrisome areas. Lindsay reckons that Google's paid clicks are expected to increase 11 percent in the U.S. and 27 percent overseas. However, revenue per click will decline 9 percent from a year ago---the first time that has happened since Google's IPO. Why? There are lower conversion rates due to the economy.

Soleil analyst Laura Martin is downbeat on Google's first quarter. Martin said:

In search, we believe ad demand has weakened (pricing pressure) and when coupled with click-through rates down 2-4%, will lead to disappointing revenue in 1Q09E. We expect the tone of the call will not suggest ad-market stabilization Advertising estimates (GOOG's revenue is 100% advertising) by independent experts keep falling, now down to negative 8-10% growth in 2009, making it the worst ad downturn in history, exceeding the 6% decline actually reported in 2001.

Martin expects more talk about how social networking is hard to monetize.

Here are a few other items worth monitoring as the guessing game continues right up to the earnings report:

DoubleClick: Lindsay expects DoubleClick to contribute about $100 million to revenue. What is the state of the display ad market and how is Google offering joint display/search packages?

YouTube: Lindsay predicts that YouTube is carrying ads on about 9 percent of its inventory but CPM rates are below the $15 he wanted and are about $5. In any case, YouTube is nearing the break even mark, said Lindsay. Martin has the polar opposite take of Lindsay. Martin said:

We estimate that YouTube will report about $250 million of revenue in 2009 vs. costs of nearly $700 million, implying a loss of $450 million. We believe that YouTube would have to achieve a $9 CPM for every video impression shown to break even, but CPMs for user-generated video tend to be measured in dimes today not dollars.

Google's expense management: Google has been actively managing costs and expenses and that's a good thing, argue analysts. However, Google's repricing of stock options was a "waste of shareholder money" and a sign that management "caved in to a concerted clamor from middle management to reward staff who missed out on the 'golden years,'" according to Lindsay.

Here's Lindsay's cheat sheet: