Intuit and Mint promise "no changes"; but maybe a few would be OK

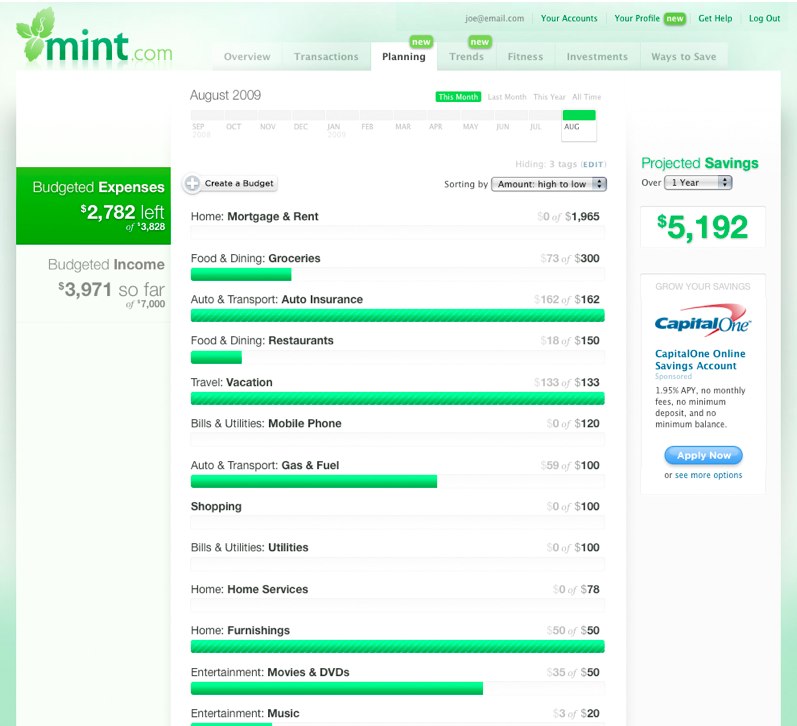

When it comes to personal finance software on the Web, I like Mint - even though I was a bit concerned that the site would change after Intuit announced the acquisition last month. But the message seems to be coming through loud and clear: Intuit has no plans to mess with Mint.

Inuit founder Scott Cook first said it a couple of weeks ago and yesterday, Mint CEO and founder Aaron Patzer repeated it. But with a company like Intuit behind it, we should expect to see some changes. In a video with Silicon Alley Insider posted yesterday, Patzer talked about plans to grow internationally, to incorporate billpay features and, of course, work hand-in-hand with Intuit products like Turbo Tax. Expect Mint to stay free, he said.

For me, a guy with a couple of bank accounts, a car loan, some credit cards and a modest portfolio of investment accounts, Mint is a great way to keep track of life's finances.

But it's no checkbook register.

OK, maybe I'm a little bit old school when it comes to my accounts, but I still like to reconcile them at the end of the statement period. Yes, I sit down and compare my records to those of the bank. Nine times out of 10, if there's a problem, it's because I forgot to account for something or even counted a deposit twice. But, on rare occasions, I have found bank mistakes, too. In recent months, since I've been using Mint and allowing it to import my transactions from my bank account into the software, I've gotten lazy at tracking my card-swipes. I've started to just trust that the information that the bank is sending to Mint is accurate.

Given the state of the economy and how we got here, trusting a bank is probably the last thing I should be doing.

As a Mint user, I want to be able to input the rare paper check I might write, a swipe of the card at the gas station or even the rare in-branch deposit. Today, I can't do that - but I'm hoping that parent company Intuit takes some of the basic banking features from Quicken (such as manual importing of transactions) and incorporate them into Mint.

In my eyes, that's not a case of Intuit changing something that's already good. In this case, Intuit would be making it better.