Tax Day 2009: Why The IRS Loves A Good Recession

The recession is helping the Internal Revenue Service. Fewer income tax returns are being filed. And, seemingly all of a sudden, more than three-quarters of individual returns are being filed electronically.

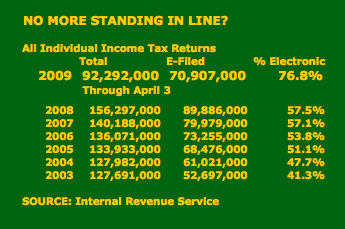

With employment in this country falling from 146.2 million when the recession began in December 2007 to 144.0 million a year later, the number of returns being filed through the outset of April has dropped 4.7%, to 92.3 million. A year ago at the same time, 96.8 million had been filed.

Meanwhile, individuals keep figuring out how to let their fingers instead of their feet do the walking to the post office or the talking with the IRS.

Professional tax preparers have been the early adopters of electronic filing for several years. Now, anyone can and is doing it. In fact, in the first three months and three days of 2009, 24.0 million self-prepared returns were filed elecrtronically. That beat all such filings (22.6 million) in all of 2007.

So the percentage of all individual returns that are filed electronically has surged -- in one year -- to 76.8%, from 57.5%.

Which means that the IRS should be able to reduce the number of hands it needs to open returns that come in paper envelopes and then scanned or otherwise entered electronically, into its storage and processing servers. Computers instead of eyes can check that much more math and spot that many more suspect items, without human intermediation. All of which means the IRS will be adding, on its own, to the unemployment totals.

Meanwhile, the year is soon arriving when TV news and online video reporting will be absent of all those last-minute-scramble-at-the-post-office stories.