Gartner: Semiconductor revenue and server shipments up, but server revenue down

Analysts at Gartner have some interesting data points for us to chew over as the year draws to a close.

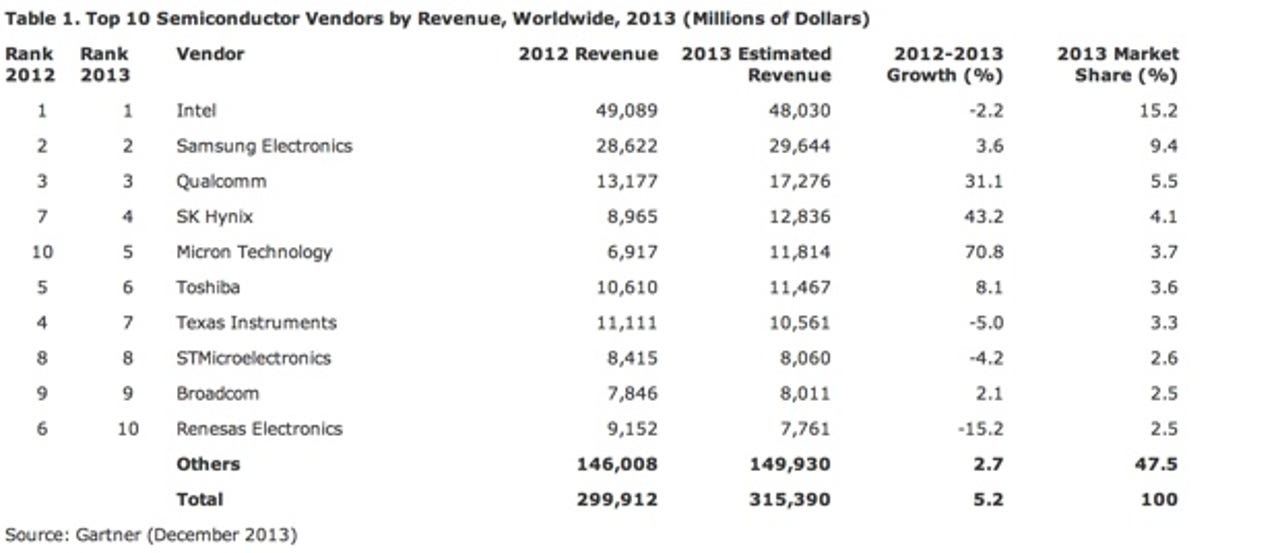

The first is that semiconductor revenues are up, propelled not by PC sales but DRAM. A preliminary analysis suggest that worldwide semiconductor revenue will hit $315.4 billion in 2013, a 5.2 percent increase from the 2012 revenue of $299.9 billion.

"After a weak start to 2013 due to excess inventory, revenue growth strengthened in the second and third quarters before leveling off in the fourth quarter. Memory, in particular DRAM, led this growth, not due to strong demand, but rather weak supply growth," said Andrew Norwood, research vice president at Gartner.

"In fact, the overall market faced a number of demand headwinds with PC production declining 9 percent and the premium smartphone market showing signs of saturation, with growth tilting toward lower-priced, entry-level and midrange smartphone models. These demand headwinds become very visible when looking at revenue growth outside of memory, where the rest of the semiconductor market could only muster 0.4 percent growth."

While Intel continues to dominate the semiconductor revenue list, companies such as Qualcomm and Samsung are gnawing at its lead. Also, Micro has shot up the listing from #10 to #5.

On the server front there's mixed news. While server shipments during the third quarter of 2013 rose by 1.9 percent year-on-year, revenue declined 2.1 percent compared to the year-ago quarter.

"The worldwide server market remains in a relatively weak performance mode as we move through the second half of the year," said Jeffrey Hewitt, research vice president at Gartner. "There were only three regions that exhibited positive vendor revenue growth. They were Canada at 6.5 percent, the Middle East and Africa at 12.1 percent and the United States with 0.9 percent growth. In shipments, the Middle East and Africa had the greatest increase at 13 percent compared to the third quarter of 2012."

HP dominates the server landscape in terms of revenue and shipments, and saw modest growth in both over the quarter. Compare this to IBM and Dell, who saw both shipments and revenue fall over the same period.

In terms of form factors, blade servers shipments fell 1.5 percent, but grew 3 percent in revenue in the quarter. The rack-optimized form factor rose 2.6 percent in shipments, but revenue fell 1.8 percent for the third quarter of 2013.

See also: