Google misses earnings, revenue targets again on Q1 report

Following a miss thanks to Motorola Mobility last quarter, the pressure was on for Google to deliver better results on Wednesday after the bell.

The short story: The pressure was too much.

Read this

Most of the Motorola unit will be on its way out soon enough following the announcement of its sale to Lenovo in January, but the beleaguered parts of the hardware maker are still with the Goog.

Thus, Google reported a first quarter net income of $3.45 billion, or $5.04 per share (statement). Non-GAAP earnings were $6.27 per share on a revenue of $15.42 billion, including traffic acquisition costs.

Excluding TAC, which rang up to $3.23 billion, revenue was $12.19 billion.

Wall Street was looking for earnings of $6.41 per share on a revenue of $15.54 billion.

As a result, Google shares started to tumble in after-hours trading. There were problems elsewhere on the balance sheet as well, namely in Google's core department: search.

Cost-per-click was down by nine percent annually, although it was flat sequentially. Paid clicks, however, were down one percent sequentially but shot up by 26 percent year-over-year.

Despite the missed targets and the weak link that is Motorola, CEO Larry Page maintained an optimistic front in prepared remarks:

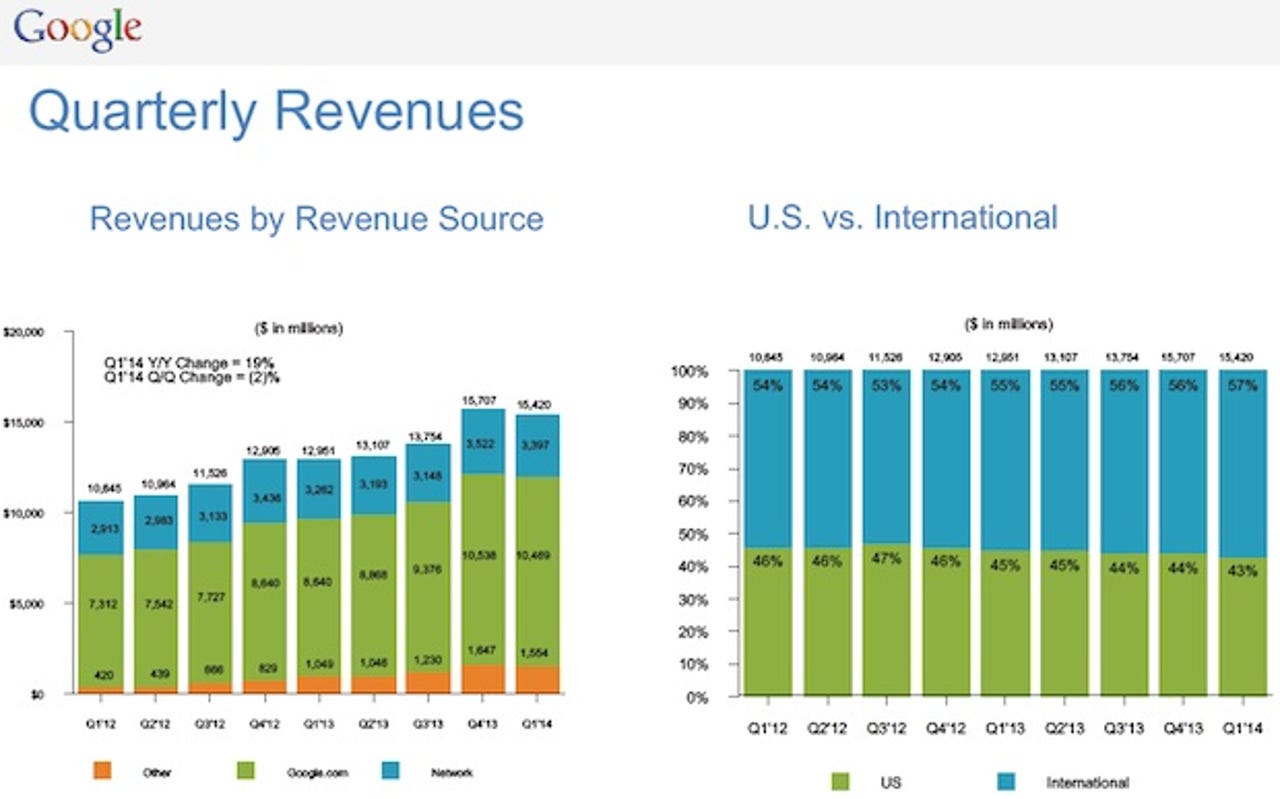

We completed another great quarter. Google's revenue was $15.4 billion, up 19% year on year. We got lots of product improvements done, especially on mobile. I'm also excited with progress on our emerging businesses.

Once again, Page did not participate in the quarterly shareholders conference call, which was led by chief financial officer Patrick Pichette and chief business officer Nikesh Arora.

Here's a closer look at Google's Q1, by the numbers:

- International revenue: $8.76 billion, accounting for roughly 57 percent of total Q1 revenue, up from56 percent in Q4 2013 and 55 percent in Q1 2013.

- Net loss from discontinued operations (including Motorola): $198 million, compared to a net loss of $182 million in Q1 2013. If Motorola was designated as its own operating segment, income for the quarter would have equaled $1.45 billion -- roughly $74 million higher than what was included in net loss from discontinued operations.

- Headcount: 49,829 full-time employees (46,170 in Google and 3,659 in Motorola Mobile) as of March 31 -- up from 47,756 full-time employees (43,862 in Google and 3,894 in Motorola Mobile) as of December 31.

- Enterprise updates: Although he didn't provide metrics, Arora went over some of the business products released during the quarter, including the Chromebox for enterprise video conferencing in February and major price reductions for Google Cloud Platform in March.

Arora delved a little deeper on the cloud unit, which is arguably more competitive now than it has ever been before. He suggested this is just the beginning:

The important part to at least acknowledge in the space of cloud computing is we think that it's very, very, very, early days. If you think about the potential scope and scale of what this opportunity is, that's pretty much every business which is going to be around for the long term has to operate in the cloud. There's no efficiency compared to the efficiency of the cloud in compared to owning your own infrastructure, running it by yourself. So this shift is going to happen. If you look at the opportunities out there and the options, there's very few options. So there's a lot of room for all of us to have a great time for many, many, years before we start worrying about differentiation and why my sort of thing is better than yours.

For the current quarter, Wall Street expects Google to report earnings of $6.36 per share on a revenue of $15.75 billion.

Charts via Google Investor Relations