AOL: Let's become an ad network before this really unravels

AOL acquired Internet advertising firm Quigo Tuesday in its latest move to transform itself into an ad network. And given AOL's financial state the rejiggering is a good idea.

In a statement AOL said it acquired Quigo, a company that provides keyword advertising along with text, display and video ads. These ads can be bought by time or impression. AOL didn't put a value on its purchase, but other reports put it at $340 million or more.

With Quigo, AOL gets the AdSonar system, a search engine marketing business and relationships with customers like Hearst, Tribune Interactive, Fox, ESPN, TheStreet.com and a bunch of Time Warner sites. More importantly AOL moves closer to becoming an ad network. In 2007, AOL has acquired Third Screen Media, a mobile advertising firm, ADTECH AG, an ad serving platform, and TACODA, a behavioral targeting company. AOL also formed Platform-A, a display advertising platform.

These ad efforts are welcome since AOL's financials aren't so hot. For the third quarter ending Sept. 30, AOL had revenue of $1.22 billion, down from $1.96 billion in the year ago quarter. Operating income was down to $295 million from $390 million a year ago.

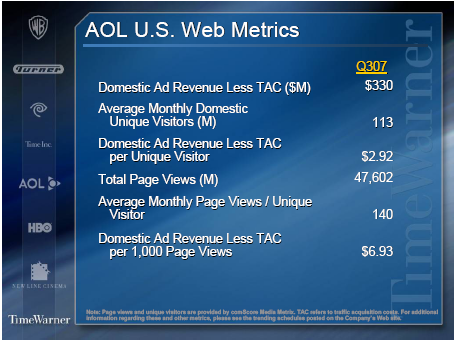

Time Warner said AOL's revenue was down 38 percent due to a 56 percent decrease in subscription revenue offset a bit by a 13 percent gain in advertising revenue. Analysts were hoping for a 16 percent gain in ad revenue. AOL sold its Internet access business in the U.K., France and Germany. AOL had 113 million average monthly visitors during the quarter and 48 billion page views.The big problem with those numbers is that they are worse than they appear. Don't bother with the earnings statement from Time Warner go right to the SEC filing.

Here's what Time Warner had to say in its 10Q filing:

- Display advertising grew 6 percent on AOL from a year ago while the total network was up 10 percent. Why? "Pricing declines and shifts in the mix of inventory sold to lower-priced inventory," said Time Warner.

- That anemic growth will actually look good two quarters from now. Time Warner said that advertising revenue for the fourth quarter "are expected to increase at a rate less than experienced during the third quarter of 2007." AOL also expects downward pressure on growth in the first quarter of 2008.

Here's the whole spiel from the SEC filing:

Total Advertising revenues for the fourth quarter are expected to increase at a rate less than that experienced during the third quarter of 2007, reflecting lower expected year-over-year growth rates for both display and paid-search Advertising revenue on the AOL Network, primarily as a result of expected continued pricing pressure on display advertising and lower expected search performance. Because of the uncertainty associated with these trends coupled with the end of commitments from a major customer of Advertising.com and the impact of the $19 million benefit recognized in the first quarter of 2007, AOL expects continued downward pressure on year-over-year growth in Advertising revenues in the first quarter of 2008.

Merrill Lynch analyst Jessica Reif Cohen said in a research note that she sees trouble ahead:

Advertising weakness at AOL was not altogether surprising, but the depth of its problem is becoming more concerning, particularly in light of both strong growth from its peers (i.e., Yahoo! branded advertising growth of +20% in 3Q) and a return to Y/Y declines in page views in 3Q (after supposedly turning the quarter in 2Q). Last quarter, the company dropped its guidance of growing “at least in line with the industry”, but now appears to have moved well below the industry.

Not too comforting. And yes folks it can get worse. Cohen reckoned that the University of Phoenix was the big AOL customer that ended its commitments. The University of Phoenix generated $162 million in revenue for the first 9 months of 2007 (roughly 10 percent of AOL's revenue) and contributed most of the growth. The problem: Apollo Group, which operates the University of Phoenix, advertises so much that it bought its own ad network. On Oct. 30, Apollo completed the purchase of Aptimus in a deal that allows the company to "best monitor, manage and control its marketing investments and brands, with the goal of increasing awareness of and access to quality and affordable education."

Without Apollo AOL will have to find other customers to pick up the ad slack.