How the Kindle Fire and the Nexus 7 harmed the tablet market

Things are not good over at Amazon.

The company pulled in a second quarter earnings of only $7 million on revenues of $12.83 billion, and the company expects the third quarter to be worse. It was also revealed that sales of the 7-inch Android-powered Kindle Fire tablet have slowed down significantly following the initial frenzy when the tablet first hit the market.

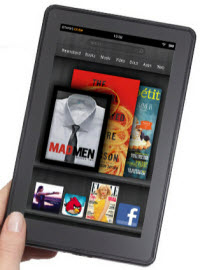

Amazon's Kindle Fire tablet came from nowhere to capture more than 50 percent of the Android tablet market. Much of the success of the tablet was put down to the price -- a highly competitive $199. Despite the recent fall in sales, the Kindle Fire continued to be Amazon's best-selling item during the second quarter, but now that Google has released competition in the form of the Nexus 7, this may well change unless Amazon can get a new Kindle Fire -- speculatively called the Kindle Fire 2 -- out of the door quickly.

ZDNet's Jason Perlow believes that the problem with the Kindle Fire is that the hardware just isn't sexy enough in the face of the Nexus 7. He believes that Amazon should bring to the table a Kindle Fire 2 with a more powerful processor, a better screen, a camera, Bluetooth, and GPS capabilities.

While I'll agree that it's time for the Kindle Fire to get an upgrade -- the current device was released November 2011 and has now been eclipsed by the Nexus 7 in terms of hardware -- bumping the hardware is unlikely to be enough to rekindle interest (pun intended) in the cheap Android tablet.

What's happening to the 7-inch tablet market is what happened to the PC market several times. Big name desktop PC OEMs, realizing that consumers didn't care about megahertz and megabytes -- yes, that long ago -- turned to a price war in order to keep sales buoyant. The same thing happened with notebooks -- although by now CPU speeds were measured in gigahertz and RAM in gigabytes -- and then later with netbooks.

Price becomes the differentiating factor, and this in turns competition into a race to the bottom. Who can make the cheapest device wins.

Prices start out at a premium level, but these were quickly, repeatedly and enthusiastically slashed until margins became razor thin and there was little room left for the OEMs to do anything but hope -- and perhaps pray -- that people would buy hardware.

Slashing product prices cuts profit margins, which in turn means less money to innovate.

The truth is that while people like Perlow and myself love new and better hardware, the mass market can't explain the difference between a dual-core and quad-core processor, or a 1024x600 screen from one running at 1280x800.

The mass market cares only about two things: price, and seeing their purchasing decisions affirmed by others.

Price is a metric that most people know and understand because it's nowhere as ethereal or complicated as CPU power or screen resolution. Given a $199 tablet next to another for $299, the $100 difference in the price tag will catch the eye before anything else.

But if price is such an important metric, why is the iPad -- with its premium price tag -- so popular?

Simple, it was the first tablet to go mass market, and after cumulative sales of around 85 million, Apple's tablet can be found in the hands of millions of people. This gives the tablet credibility in the eye on potential buyers and sells it better than any ad campaign could hope to achieve.

People love seeing their buying decisions affirmed by others, and if they're seeing lots of others using the same device that they've chosen, they're getting affirmation in spades.

If Amazon is heading for a third quarter crisis, then that doesn't give the company an awful lot of wriggle room when it comes to spending more on hardware while keeping the price fixed. And that's the inevitable problem with aggressive price cuts. It happened to the desktop PC industry, notebooks PCs and then netbooks. Margins then fell to a point where innovation stagnated which in turn led to the problems that the PC industry currently finds itself in.

So the problem with the Kindle Fire -- and the Nexus 7 -- is the same problem that's plagued the PC industry. Deep and extreme price cuts give the makers no wriggle room to innovate. There's no doubt that a $199 was an attractive price point for a tablet, but it's possibly that it was unsustainably low, and that by driving prices down to this level so rapidly, both Amazon and Google have irrevocably harmed the tablet market by creating unrealistic price expectations. It's quite likely that these impracticable price demands could harm Microsoft and its tablet ambitions.

There is no shortage of pundits who believe that Apple should itself be venturing into the 7-inch tablet market with its own low-priced offering. However, given that the wheels may have fallen off Amazon's juggernaut, that advice may have been somewhat premature. Given Apple's sales and profits, I think the company doesn't need to follow the likes of Amazon and Google into such a cut-throat, competitive market.