IBM's Q1 revenue disappoints, hardware whacked again

IBM's first quarter results highlighted how the company is still at the beginning point of a transition as hardware sales plunged, revenue fell short of expectations and few divisions showed any growth.

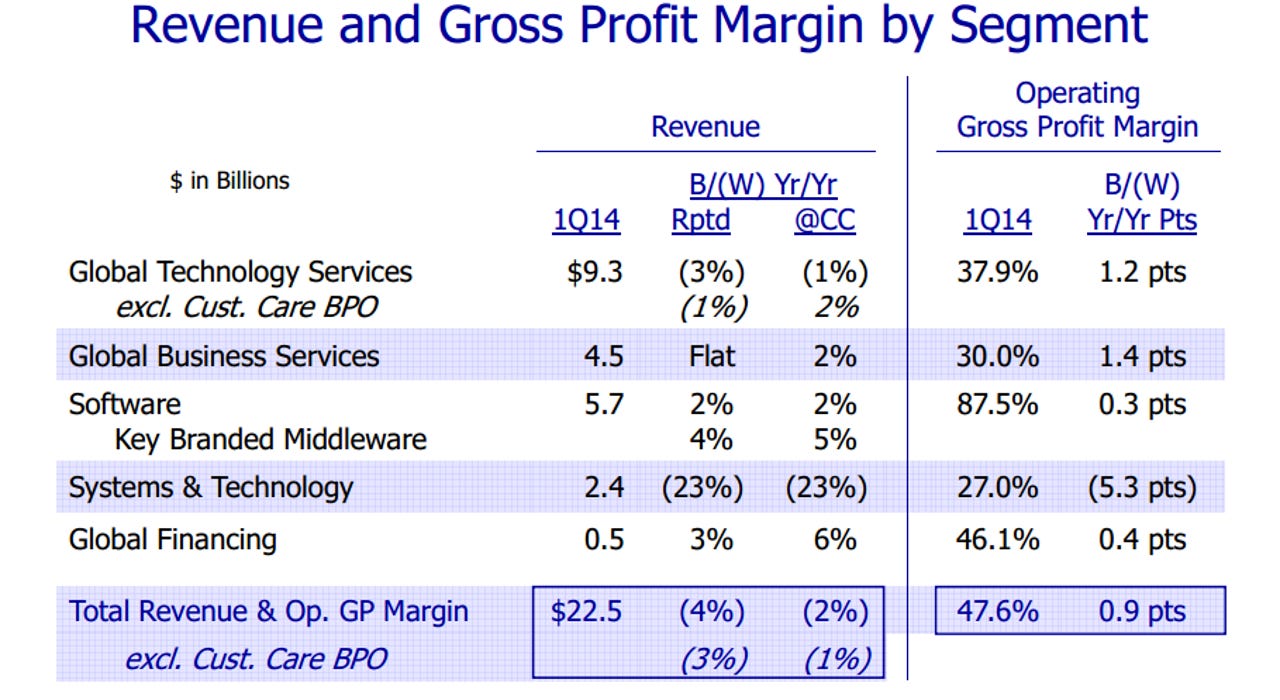

Big Blue reported first quarter earnings of $2.4 billion, or $2.29 a share, down 21 percent from a year ago. First quarter sales were $22.5 billion, down 4 percent from a year ago. IBM's net earnings included a $870 million charge for layoffs and a gain of $100 million for the sale of its customer service outsourcing business.

Non-GAAP earnings were $2.54 a share in the first quarter.

Wall Street was expecting IBM to report first quarter earnings of $2.54 on a non-GAAP basis on revenue of $22.91 billion.

As for the outlook, IBM said it could hit $18 a share in non-GAAP earnings for 2014. CEO Ginny Rometty said the company continues to transition to higher growth businesses such as Watson and the cloud.

What ails IBM is illustrated by its business unit breakdown. IBM's core businesses, with the exception of software, just aren't growing and struggling to stay flat.

The software unit was led by middleware, but the hardware unit was whacked by declines in System z mainframes, Power Systems and storage.

CFO Martin Schroeder said:

Systems and technology revenue of $2.4 billion was down 23%. This reflects both the product cycle of System Z and the secular challenges in you Power, storage and System X. In January, we entered into a definitive agreement with Lenovo to divest our System X business. And in the first quarter, we continued to reposition offerings in other parts of our hardware business to make them more relevant.

Schroeder said that divesting System x to Lenovo will result in a smaller more profitable hardware business. He also added that the launch of Power 8 will also drive hardware.

He also indicated that IBM is investing in growth businesses such as Watson and Bluemix and isn't scrimping on research and development. The mobile business doubled from a year ago.

In the end, Schroeder acknowledged that IBM's quarter could have been better, but the company's transition is well underway. He added:

We did get a lot done this quarter. We did transition more of our business into big data and analytics. We continue to move into the cloud with good growth in mobile and security.

Other key points:

- Revenue in Brazil, Russia, India and China fell 11 percent in the first quarter.

- Revenue from Europe, Middle East and Africa showed growth of 4 percent, but Americas fell 4 percent and Asia Pacific sales dropped 12 percent.

- Cloud revenue was up more than 50 percent with a first quarter annual run rate approaching $2.3 billion.