IBM's Q2 earnings strong, revenue light

IBM's second quarter earnings were better than expected, but the company took a hit on currency fluctuations that led to lower-than-expected sales.

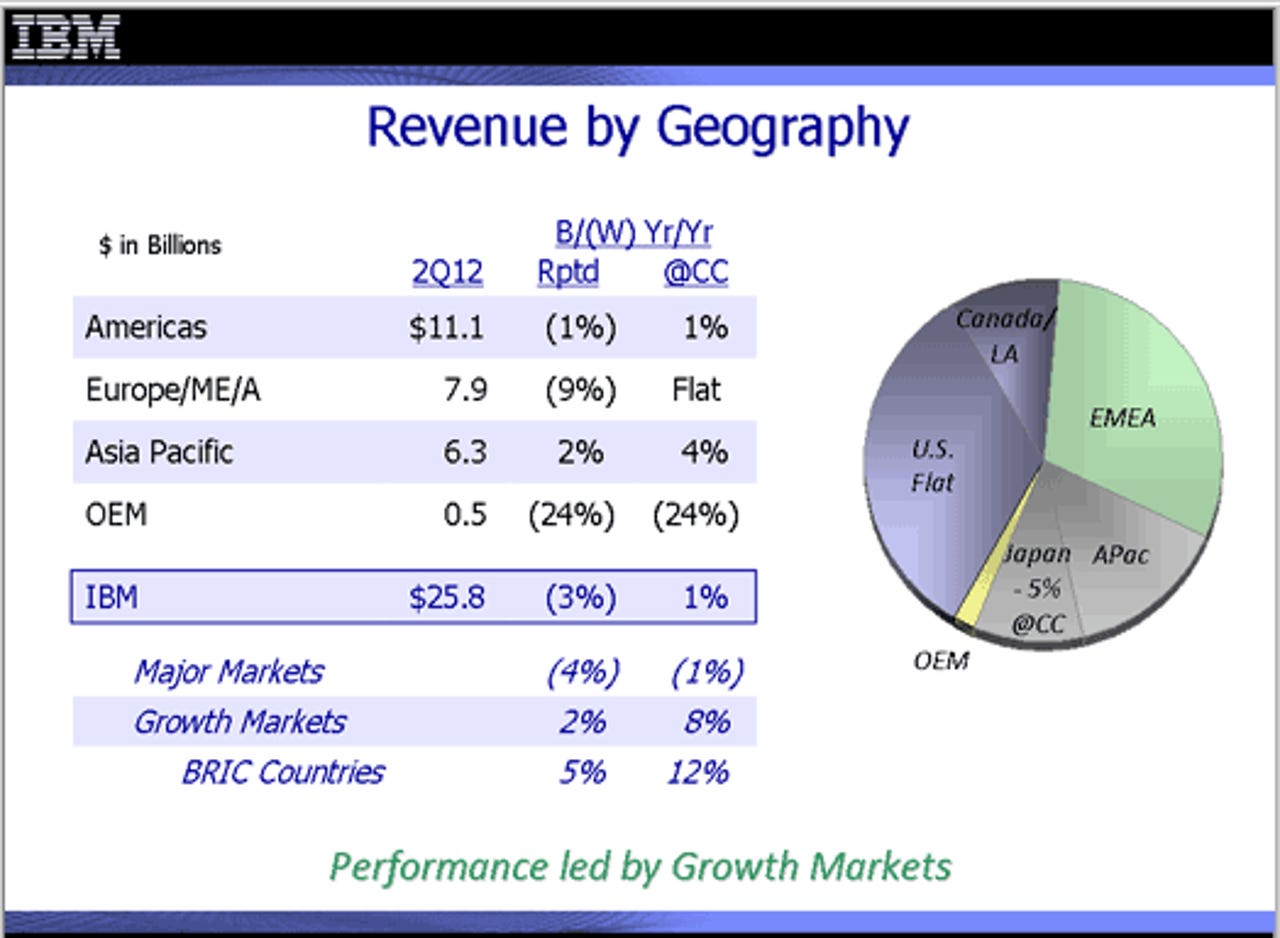

The software, services and integrated hardware giant reported second quarter earnings of $3.9 billion, or $3.34 a share, on revenue of $25.8 billion, down 3 percent from a year ago. Currency shaved about $1 billion from IBM's revenue. Non-GAAP earnings were $3.51 a share.

Wall Street was expecting IBM to report second quarter earnings of $3.42 a share on revenue of $26.27 billion.

As for the outlook, IBM said it is on track for delivering operating earnings of at least $15.10 a share for 2012.

In a nutshell, IBM is hitting earnings targets with solid expense management, but the currency fluctuations are hampering revenue growth. Companies with sales in the U.S. dollar show more growth when the greenback is weak.

Aside from cloud, analytics and smarter planet revenue, IBM delivered sluggish to lower sales growth. In a statement, IBM CEO Ginni Rometty said the company was upbeat about "strength in our growth initiatives and investments in higher value opportunities."

On a conference call with analysts, IBM CFO Mark Loughridge made the following points:

- Loughridge also talked up competitive server wins. He said:

We continued our success in competitive displacements in the second quarter, with over 320 displacements that drive over $265 million of business. As you would expect, these came from a combination of HP and Oracle Sun.

- IBM's hardware business is slowing due to where it stands in the product cycle. "We continue to extend our share leadership in our two high end server brands," he said.

- Currency fluctuations became harder to manage. "We entered the quarter with a currency head wind, but it got even tougher over the last 90 days," said Loughridge.

- The global economy is mixed. Loughridge said:

In the Americas, Canada was up, while the U.S. again was flat year to year. EMEA was also flat year to year, slowing just a point from last quarter's growth rate, but still relatively stable. As in the past, there is a good bit of variability by country. We had growth again in the UK and Spain, Germany was flat, while France and Italy declined.

- China revenue was up more than 20 percent from a year ago. IBM is expanding its branch offices across China.

- "We had about $150 million of work force rebalancing in the quarter, primarily in Europe," said Loughridge.

Loughridge also addressed how IBM grew earnings without revenue growth. He said:

Margin expansion was the largest contributor to growth, as our continued focus on productivity and mix to higher value drove improvements in gross pretax and net margins year to year. And our ongoing share repurchase program contributed the balance, at a level fairly consistent with last quarter...Another important and unique aspect of our model is the balance between annuity business and transaction businesses. Our annuity businesses, which make up the majority of services and software, reflect our long-term relationships with our clients and provide a solid base of revenue profit and cash. We have had underway for sometime a series of initiatives to drive productivity. These are real structural changes that improve our business and margins over time.

The big takeaway from IBM's quarter is that the global economy is lumpy---even excluding currency fluctuations---but the company has a lot of earnings leverage in its business model. As a result, IBM shares moved higher in afterhours trading.

Among the key points:

- IBM's results are a proxy for the global economy in many respects. The sales growth in emerging markets vs. Europe tell the tale.

- The software business, which has recently showed decent growth, is slowing.

- IBM's hardware unit saw revenue declines across the board.

- Services remain a cash cow, but backlog fell 6 percent in the second quarter.