IDC: iPad retains tablet share crown, Android rapidly catching up

Latest statistics from research firm IDC show while Apple retains the crown in the tablet market share space, Google-owned Android is quickly catching up quarter on quarter.

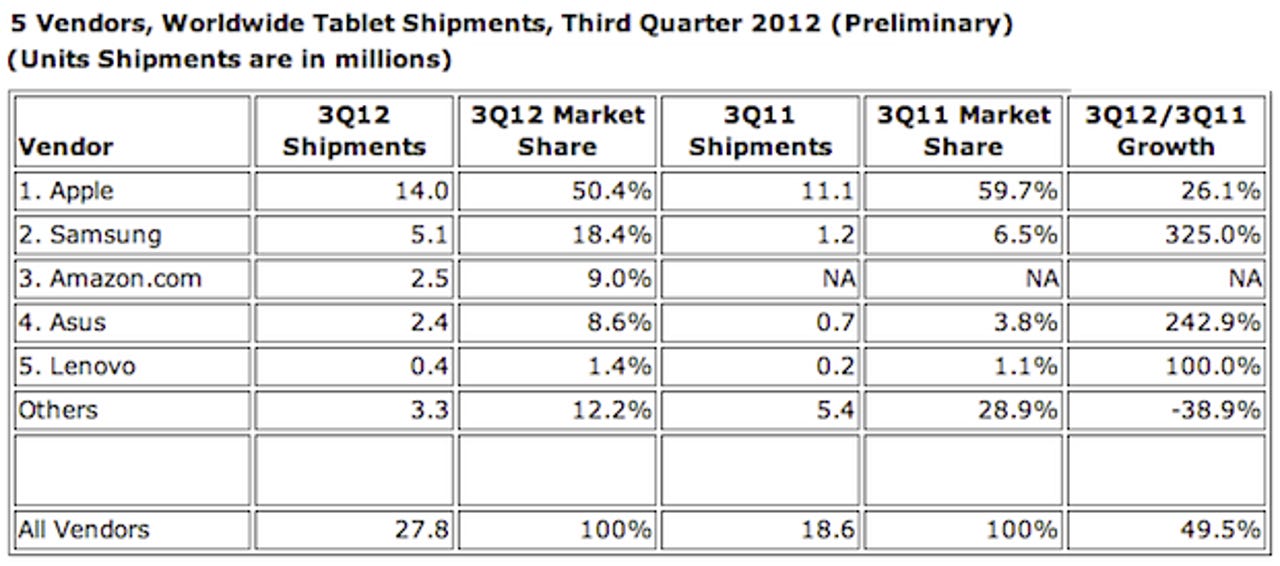

In all, IDC pegs the total tablet shipments at 27.8 million during Q3 2012, an increase to just shy of 50 percent year-over-year and a 7 percent increase on the previous second quarter.

The greatest gain came from Android, thanks to the bevy of manufacturers offering the 'alternative' operating system, at the expense of Apple, which gained in shipments but lost out significantly in market share.

Though Apple surged by 26 percent in the third quarter year-over-year, Samsung's tablet share rocketed by 325 percent, while Asus saw an increase of more than 240 percent. Combined shipments total 7.5 million Android units compared to 14 million iPad shipments -- almost double -- but quarter on quarter, the odds are stacking in Android's favor.

Since the second quarter, where Apple's tablet market share stood at 65.5 percent, it's now reduced to just over half of the overall tablet share.

While Apple has yet to reach the so-called 'saturation' point with its iPad tablet, sales are slowing down. The introduction of the 7-inch iPad mini last month may reinvigorate sales among the petite tablet niche, but Apple has hinted during its fourth quarter earnings call that the profit margin is far slimmer than its larger iPad counterpart, therefore profits may suffer as a result.

Apple recently stated it had sold the 100 millionth iPad, but the figure disappointed analysts, coming in short of their expectations. The technology giant's fourth quarter ended abruptly as a result, after the company missed estimates, thanks to less-than-expected sales in the iPad division, despite an increase in sales by more than one-quarter on the same quarter a year ago.

For the Cupertino, CA.-based maker of shiny rectangles, the 7-inch tablet strategy was an all-but inevitable if the company wants to cling on to the top spot in tablet market share.

But at the same time, Apple's iPad mini pricing point of $329, in spite of its arguably better design and closed software--hardware ecosystem, will leave many heading in the direction of Android- and Windows-powered tablets.

Meanwhile, Microsoft's debut into the tablet market, the business and enterprise ready Surface tablet, has yet to make in-roads. Interest in the Windows-powered tablet, designed for business users and bring-your-own-device (BYOD) users alike, has taken the software-turned-tablet maker by surprise, as deliveries slowed down across Europe after there weren't enough shipments to go around.

Microsoft is expected to build 3-5 million Surface tablets this quarter, according to reports, as the company charges itself with contending with Apple in the niche business-only space.