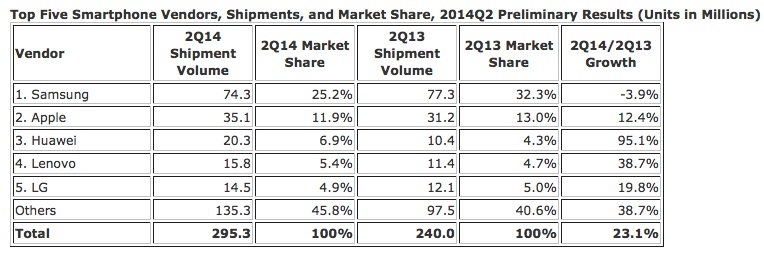

IDC: Smartphone shipments surge again while featurephone 'death' draws nigh

The global smartphone market shows no signs of slowing down, based on the latest pulse check conducted by IDC.

The market research firm estimated 295.3 million units shipped worldwide during the second quarter of 2014, representing annual growth of 23.1 percent.

Read this

On a quarterly basis, growth was only 2.6 percent, but IDC program director Ryan Reigh reflected in the report that the "record second quarter" points toward "plenty of opportunity and momentum."

Reigh continued:

Right now we have more than a dozen vendors that are capable of landing in the top 5 next quarter. A handful of these companies are currently operating in a single country, but no one should mistake that for complacency – they all recognize the opportunity that lies outside their home turf.

China continues to be a focal point for all mobile OEMs — to the point where even homegrown Lenovo is facing increasing pressure but still hanging on with record shipments of its own.

In fact, Chinese mobile OEMs are putting more pressure on other hardware brands outside of China, especially in emerging markets as the featurephone continues to find itself on the way out amid the rise of cheaper smartphones.

"The offer of smartphones at a much better value than the top global players but with a stronger build quality and larger scale than local competitors gives these vendors a precarious competitive advantage," explained Melissa Chau, a senior research manager for on IDC's Worldwide Quarterly Mobile Phone Tracker team.

The smartphone report follows IDC's update last Thursday on the global tablet market.

While still projecting double-digit annual growth for the form factor, IDC analysts warned against getting too comfortable following quarter-after-quarter of astronomical growth.

Nevertheless, tablets might still continue to enjoy a longer boom in the business sector as analysts reflected the recent Apple/IBM partnership will boost tablet usage with more enterprise-specific offerings.

Looking forward, IDC analysts project that smartphone shipments will break the 300 million unit mark during the third quarter for the first time ever.

Chart via IDC